Without doubt, there are lots of reasons to deteriorate your credit report and credit score

Obtaining a conventional loan or line of credit could be daunting if you’ve got bad credit. As you need a loan to build your credit, getting the loan would be an uphill task. But the great news is that you can get a secured credit card with bad credit. Some lenders could be more willing to issue credit cards to customers even if they have history. Basically, you are going to have to put a deposit which works as collateral in case the balance goes unpaid. To apply for the card, you will give the necessary identification and financial advice. After granting the issuer permission for a soft query, you’ll initiate the trade to get the deposit. Some card issuers also request your approval to allow them to draw the deposit directly from your accounts. There’s a good difference between standard credit cards and secured cards. You’ll undoubtedly have some constraints and miss out on some unsecured credit card benefits.

Across the united states, using a credit card proceeds being one of the most efficient fiscal instruments. Countless consumer accounts tip to their unbowed attempts to acquiring a credit card. Like every other product, a credit card includes a whole range of advantages and related advantages. Through application, credit card issuers look at many metrics before approving your card software. This variable means that your chances of acceptance if you have a poor score, are incredibly slim. Besides, you are going to need to see a couple of things as soon as you get your card. If you go beyond the 30% credit usage limitation, your credit score will undoubtedly drop. Through the program, the issuer could carry out a tough question that would fall your credit rating. The further you have unsuccessful software, the more inquiries you are going to have in your report. Once you get the card, adhering to the stringent credit regulations will work to your leverage. Failure to comply with the regulations will tank your credit score and harm your report.

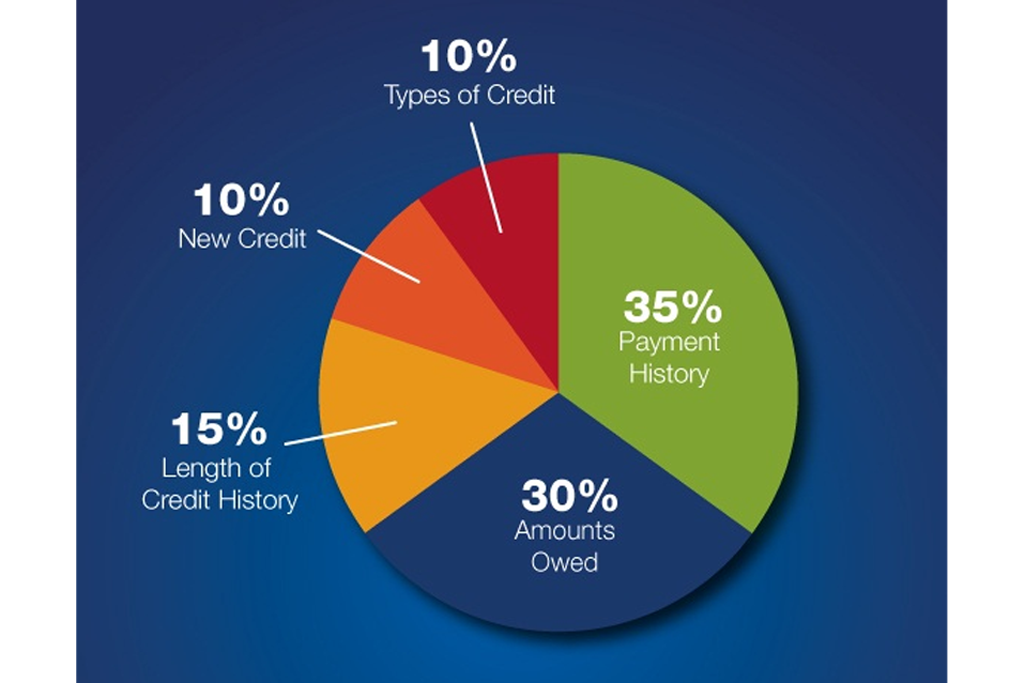

One perplexing thing which most people wonder is whether taking out a loan may hurt their credit score. At a glance, loans and the way you manage them determine the score which you are going to ever have. Different companies use different credit calculation versions, and they’re able to boost or drop your credit score. Having several delinquencies would continuously plummet your credit score. Your credit report is a snapshot that lenders use to ascertain whether you are creditworthy. There is some speculation around the essence of the check since you need a loan to construct a background. When this loan program is the very first one, your odds of success might be very slim. Having said that, the relationship between loans is a terminal string, and you are going to need a loan to prove yourself. Potential loan issuers might approve your application if you have cleared all your bills in time. But when you’ve got a history of defaulting, prospective lenders might question your capacity to pay. If you have damaged your report before, taking a fresh loan might help you restore it. The debt quantity accounts for more than 30 percent of your credit file, and you ought to pay much attention to it.

In all US states, many men and Credit Tips women work so tough to make purchases using a credit card. Countless consumer accounts point to their unbowed efforts to acquiring a credit card. Of course, a credit card has a whole selection of perks and several drawbacks too. First off, credit card issuers look at your score prior to issuing you credit card. When you’ve got a bad credit score and history, your chances of getting a card could be meager. You’ll have to consider your spending habits, utilization, and payments after getting the card. If you neglect to keep good financial habits, your credit score will certainly drop. Through the program, the issuer would carry out a hard question that would fall your credit rating. The more your program flops, the more inquiries are added to a report. When it comes to using the card, several exemptions adhere to high regularity standards. Failure to adhere to the standards would hurt not only your score but also pose long-term implications.

Primarily, several items could be harmful to your credit report and tank your credit rating. Basically, credit repair is the procedure for repairing your credit by deleting the harmful entries. In some instances, it might only entail disputing the negative entries using the various bureaus. Contrary to the simple process of disputing negative items, identity theft could be painstaking. For a walkabout for this daunting process, you are going to have to hire a repair company to prevent complexities. Additionally, this situation is frequently accompanied by a long chain of complicated criminal activities. Certainly, unraveling these chains may be an uphill task if you do it on your own. Although some customers have solved identity theft on their own, a repair agency is often an ideal way. Admittedly, deleting negative entrances involves a massive of complexities and legal technicalities. In any case, you may complete the process independently or employ a credit repair company If you cherished this article and you simply would like to obtain more info relating to click through the next page generously visit our own webpage. .

Primarily, several items could be harmful to your credit report and tank your credit rating. Basically, credit repair is the procedure for repairing your credit by deleting the harmful entries. In some instances, it might only entail disputing the negative entries using the various bureaus. Contrary to the simple process of disputing negative items, identity theft could be painstaking. For a walkabout for this daunting process, you are going to have to hire a repair company to prevent complexities. Additionally, this situation is frequently accompanied by a long chain of complicated criminal activities. Certainly, unraveling these chains may be an uphill task if you do it on your own. Although some customers have solved identity theft on their own, a repair agency is often an ideal way. Admittedly, deleting negative entrances involves a massive of complexities and legal technicalities. In any case, you may complete the process independently or employ a credit repair company If you cherished this article and you simply would like to obtain more info relating to click through the next page generously visit our own webpage. .

0 comentário