The FCRA provides the provision to eliminate any harmful element on your credit report

There are lots of items which can affect your credit report and tank your score. Essentially, credit repair is the procedure for fixing your credit by minding the harmful entries. In some instances, it may just entail disputing the negative entries with the various bureaus. Contrary to the straightforward process of disputing negative items, identity theft could be painstaking. Since fixing fraud problems entails a great deal of legal complexities, you might need to engage a repair company. Also, fraud and identity theft usually entail a chain of well-choreographed criminal pursuits. In case you don’t hire a credit repair firm, unraveling these links may prove futile. Though some people solved this issue independently, involving a provider is usually the best way. Because of these complexities, you might need to hire a repair business that will aid you. In whichever situation, involving a repair business or working in your may be fruitful.

Sky blue credit is a credit repair company that was built in 1989 and is currently based in Florida. Clients using credit saint to fix credit claim they begin seeing positive progress following 30 days. Additionally, the company asserts that customers use their solutions for six months to achieve full outcomes. From online credit checks and tracking, many perks are directly associated with this corporation. In the course of your subscription, you can pause the subscription by calling customer support. In addition, you can receive a refund so long as you maintain within 90 days of subscription. Besides the advantages, skies blue has some related downsides too. You’ll pay a $39.95 retrieval fee even before beginning the credit repair procedure. Despite having the guarantee for results, you are going to need to pay $69 to set up the process. Quite simply, you are able to pay for weeks without seeing a considerable increase in your score. Since repairing credit requires some significant investment, you should make your decisions carefully.

Sky blue credit is a credit repair company that was built in 1989 and is currently based in Florida. Clients using credit saint to fix credit claim they begin seeing positive progress following 30 days. Additionally, the company asserts that customers use their solutions for six months to achieve full outcomes. From online credit checks and tracking, many perks are directly associated with this corporation. In the course of your subscription, you can pause the subscription by calling customer support. In addition, you can receive a refund so long as you maintain within 90 days of subscription. Besides the advantages, skies blue has some related downsides too. You’ll pay a $39.95 retrieval fee even before beginning the credit repair procedure. Despite having the guarantee for results, you are going to need to pay $69 to set up the process. Quite simply, you are able to pay for weeks without seeing a considerable increase in your score. Since repairing credit requires some significant investment, you should make your decisions carefully.

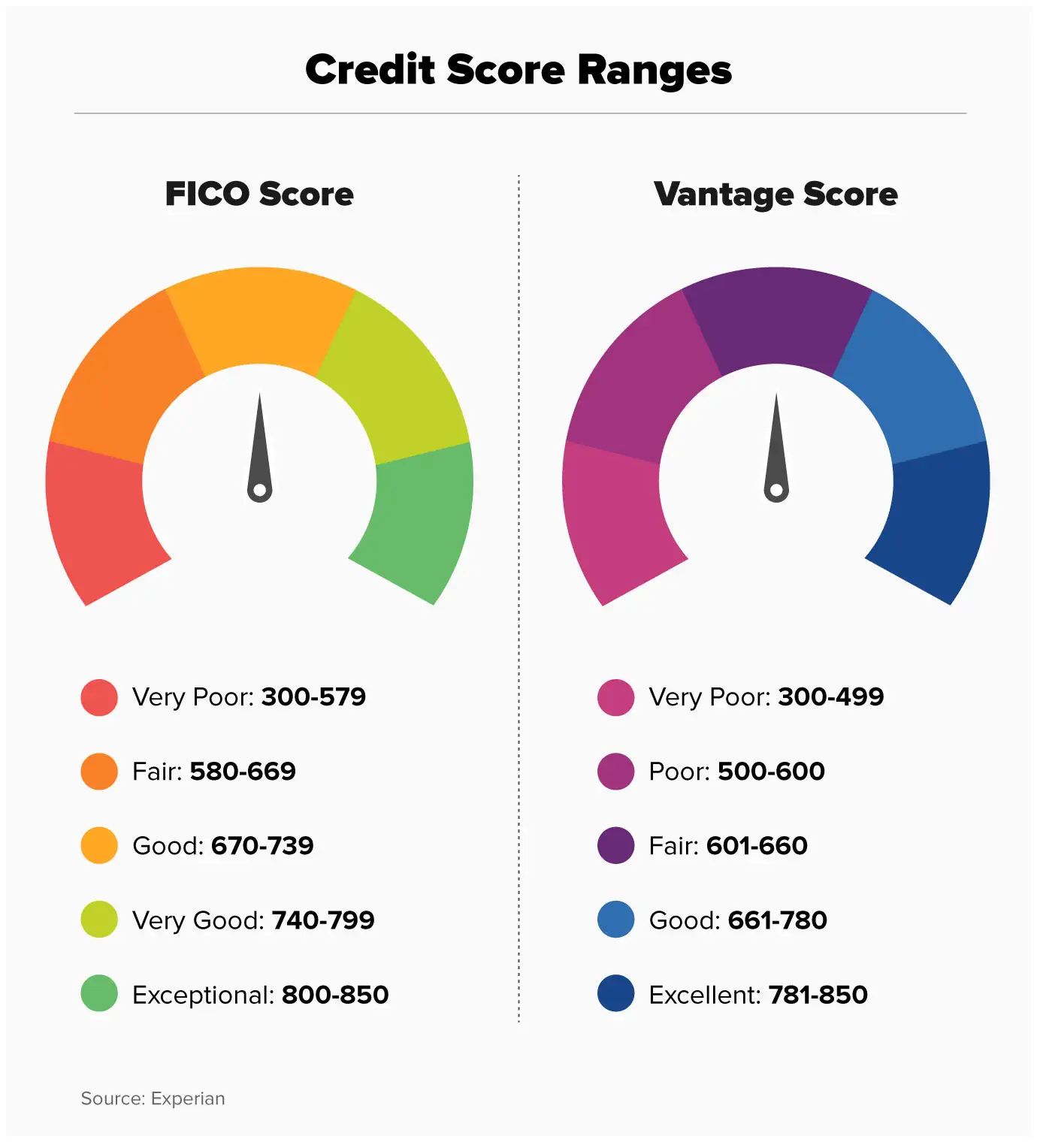

Potential lenders do not check your whole credit report; they use your score to judge you. Different lending companies utilize customized approaches to take a look at their customers’ reports. Besidesthey utilize this model because different credit card companies have different credit score versions. Your program will less likely succeed when you’ve got a bad credit rating and report. In rare circumstances, your program might be successful, but you’ll pay high-interest rates and charges. For this reason, you should watch your finances to assist you avoid any issues. Assessing your credit rating often would give you a clear summary of your financial well-being. You can retrieve a free credit report from each of the information centers for free. Retrieve your report and inspect the components that could hurt your credit report. You should begin working on the simple items before involving paralegals in taking away the complex ones. There are many repair companies; hence you should select your desired one sensibly. Having good fiscal habits and checking your report frequently would help you stay on top of your finances.

Consumers’ appetite for failure and loans to fulfill their obligations caused bankruptcies. Filing bankruptcy may offset some debt from you, but you should know some implications. While submitting a bankruptcy sounds like a fantastic deal, you do not wish to suffer consequences that can last a decade. Moreover, a bankruptcy could reduce your success rate of negotiating for positive interest rates. At a glance, filing for bankruptcy would force you to experience countless hurdles and legal complexities. The very first step will be expressing your inability to cover the loan and moving through credit counseling. After this step, you are going to have to choose whether to file chapter 7 or chapter 13 bankruptcy. Once you choose the bankruptcy to document, you are going to have to clear all related legal fees. Filing bankruptcy has severe consequences, hence avoiding it’s an ideal choice. Filing bankruptcy affects the perspective with which lenders see you, hence you should avoid it.

Consumers’ appetite for failure and loans to fulfill their obligations caused bankruptcies. Filing bankruptcy may offset some debt from you, but you should know some implications. While submitting a bankruptcy sounds like a fantastic deal, you do not wish to suffer consequences that can last a decade. Moreover, a bankruptcy could reduce your success rate of negotiating for positive interest rates. At a glance, filing for bankruptcy would force you to experience countless hurdles and legal complexities. The very first step will be expressing your inability to cover the loan and moving through credit counseling. After this step, you are going to have to choose whether to file chapter 7 or chapter 13 bankruptcy. Once you choose the bankruptcy to document, you are going to have to clear all related legal fees. Filing bankruptcy has severe consequences, hence avoiding it’s an ideal choice. Filing bankruptcy affects the perspective with which lenders see you, hence you should avoid it.

Utilizing Credit Saint to cure broken credit could be an ideal alternative for you. It’s among the few associations with an A+ BBB rating; hence it has plenty to offer. Credit Saint has assisted consumers resolve credit problems for more than a decade consequently has a fantastic history. The biggest benefit of this provider is the way that it educates consumers on various credit elements. Besides, it’s three packages– Polish, Clean Slate, and Credit Remodel — from which you pick. When preparing dispute letters, the paralegals personalize the claims according to your specific requirements. One noteworthy benefit of this provider is your 90-day money-back guarantee in the event you’re not entirely satisfied. Unsurprisingly, charge saint has some associated drawbacks. The company has high setup fees ranging from $99 to $195 and has limited accessibility. If you are residing in South Carolina, you might need to think about other repair businesses.

0 comentário