Based on the FCRA, you can dispute any negative element on your credit report

Your credit report exclusively entails your own debt and existential credit scenario. Mostly, you’ll qualify to run a standard checking account if you have had a fantastic history. When you’ve got a terrible history, you might have to consider second chance checking accounts. During application, your prior history of making several accounts would not affect you. An overdraft won’t appear in your report if you don’t fail to make timely payments. On the flip side, the overdraft might appear if the bank turns the sum to a set. That said, you’ll find restricted scenarios when this accounts can drop your score. Through application, some banks can execute a soft inquiry on your credit report. Besides, should you submit an application for a checking account, an overdraft position would impact your credit report.

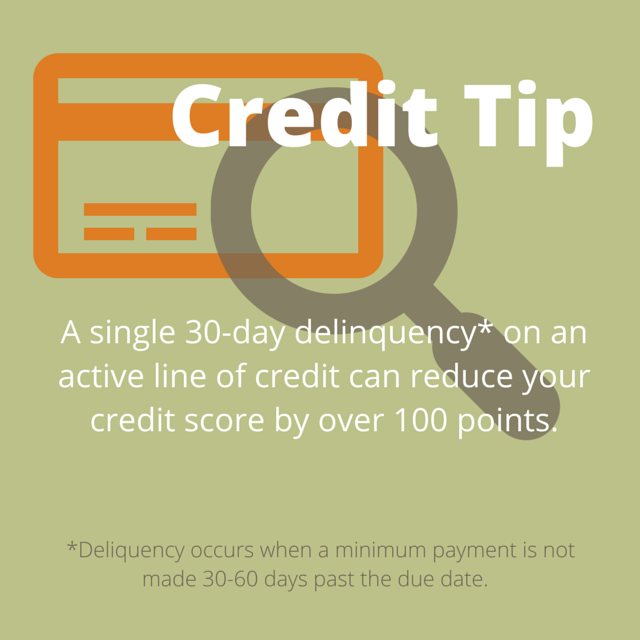

Defaulting can hurt your credit report and shed your credit rating significantly. Making timely payments accounts for a massive chunk of your report, thus defaulting can impact you. Your credit score could continually plummet if you already possess a considerably low score. If some unprecedented circumstance comes your way, making late payments can be understandable. In case your difficulty is explainable, some loan issuers could give you room to make the payment. In the event that you continuously make overdue payments, potential lenders could see you at another standpoint. The federal law states that late payments would only be reported when they are 30 days late. Going past this window could influence your ability to find additional loans from prospective lenders. Constant delinquencies would make lenders perceive you as a high-risk borrower. In conclusion, making timely payments will undoubtedly work to your leverage.

The FCRA explicitly states that you can dispute any negative item on a credit report. The credit reporting agency is obligated to delete a disputed thing that is found to be illegitimate. Like any other entity, credit information centers tend toward making lots of mistakes, particularly in a credit report. The FCRA reports that roughly 1 in every 5 Americans (20 percent ) have errors in their credit reports. Since your report goes hand in hand with your score, a bad report could severely hurt your score. Because your score tells the kind of customer you’re, you need to place heavy emphasis on it. Most loan issuers turn down programs since the customers have a poor or no credit score report. It’s vital to work on removing the negative entries from the report keeping this factor in mind. Late payments, bankruptcies, challenging inquiries, paid collections, and fraudulent activity can affect you. Since negative things can impact you badly, you should work on removing them from the report. You can remove the negative items by yourself or require a credit repair firm. Several consumers choose to use a repair company when they realize they can’t undergo all hoops. To make certain you go through each of the steps with ease, we’ve compiled everything you need to know here.

Federal bankruptcy courts came up with bankruptcies to reduce significant financial burdens on people. While it may help you avoid debt, you have to understand the long term consequences. You may have a temporary relief if you file for bankruptcy, but its effects can last for a decade. Besides, a bankruptcy would diminish your success rate of negotiating for favorable interest rates. At a glimpse, filing for bankruptcy could force you to experience numerous hurdles and legal complexities. The first step would be expressing your inability to cover the loan and going through credit counseling. The following step would be deciding whether you will file chapter 7 or chapter 13 bankruptcy. Whichever the case, you’re pay the associated fees — both court charges and attorney fees. Preventing bankruptcy is an perfect choice as you’ll lose considerably more than what you gained. Moreover, it seriously hurts your credit and affects how potential creditors would see you.

Across the united states, a credit card is still one of the most coveted monetary tools. Without a doubt, almost everyone in the US works to get financial freedom by means of a charge card. Naturally, a credit card includes a wide range of perks and lots of drawbacks as well. First card issuers think about several components of your own credit report before approving your application. In other words, having a low credit score would almost guarantee a flopped application. Moreover, you’ll want to see a few things as soon as you acquire your card. Habits like defaulting, exceeding the credit utilization limit would affect your credit report and score. Additionally, the application adds a hard inquiry to your report, which also impacts your score. The more your application flops, the further questions are added to your report. When it comes to utilizing the card, several issuers adhere to high frequency standards. Failure to comply with the regulations will tank your credit rating and harm your report.

Across the united states, a credit card is still one of the most coveted monetary tools. Without a doubt, almost everyone in the US works to get financial freedom by means of a charge card. Naturally, a credit card includes a wide range of perks and lots of drawbacks as well. First card issuers think about several components of your own credit report before approving your application. In other words, having a low credit score would almost guarantee a flopped application. Moreover, you’ll want to see a few things as soon as you acquire your card. Habits like defaulting, exceeding the credit utilization limit would affect your credit report and score. Additionally, the application adds a hard inquiry to your report, which also impacts your score. The more your application flops, the further questions are added to your report. When it comes to utilizing the card, several issuers adhere to high frequency standards. Failure to comply with the regulations will tank your credit rating and harm your report.

0 comentário