No doubt, there are lots of reasons to deteriorate your credit score and credit rating

Many people continually wonder if taking out a new loan could hurt their credit score. In brief, loans and how you handle them is a critical element in determining your credit score. Credit calculation is generally a complicated process, and loans may either boost or drop your credit rating. If you always default on your payments, your credit score will undoubtedly drop. Your credit report is a snapshot that creditors use to determine whether you are creditworthy. This fact could be counterintuitive since you need a loan to build a positive payment history and report. If this loan application is the first one, your odds of success might be rather slim. To qualify for a new loan, you’ll require a fantastic history and use ration to be qualified for credit. If you have had a fantastic payment history previously, the loan issuer might think about your program. In the event that you always make late payments, potential lenders will question your loan eligibility. Taking out new loans might provide you the chance to build your credit if you had damaged it. Because debt quantity accounts for a substantial portion of your report, you need to give it immense attention.

Established in 1989, sky blue is a credit repair company that is based in Florida Charge saint argues that most consumers start seeing positive results after 30 days of usage. Besides, the business highlights that customers use their services for six weeks to become completely satisfied. Out of online credit ratings and monitoring, many perks are linked with this corporation. If you would like to pause your support subscription, you can do so by contacting customer support. If you fail to achieve the desired results, you can receive a refund so long as you maintain within 90 days. Certainly, skies blue has some drawbacks, particularly on the setup and credit report charges. The preliminary step is paying a recovery fee of $39.95 before they start fixing your credit. Moreover, you are going to need to pay $69 to begin the process though you won’t have a warranty for results. In other words, you are able to renew your subscription for months without seeing substantial progress. Since fixing credit requires some significant investment, you should make your decisions carefully.

In brief, your credit report entails your present financial situation and debt quantity. Typically, you’ll be qualified for a typical checking account when you’ve got a fantastic credit history. Nonetheless, you may have to consider other options if you have a bad history. A history of a checking account with another financial institution wouldn’t influence your application. When you have an overdraft, defaulting are a guarantee that it would look in your account. However, if the bank turns the bill to a collection agency, the overdraft might seem. That said, you’ll find limited scenarios when this account can drop your own score. Some banks may check your credit report before approving your application for a checking account. The inquiry or program to get overdraft protection could normally tank your credit rating.

In brief, your own credit report entails your current financial situation and debt volume. You’ll be eligible for a standard checking account if you have a good credit history. If that is not the case, you might have to go to get a checking account for bad credit. A checking account with a bank would not have any effect on you. An overdraft will not appear in your report if you don’t fail to make timely payments. On the flip side, the overdraft might appear if the bank turns the sum to a collection. Therefore, there are limited situations when a checking account could damage your credit rating. Some banks may check your credit report before approving your application for a checking account. The query or application for overdraft protection could generally tank your credit rating.

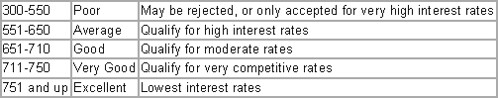

Instead of assessing your entire report, potential lenders use your credit rating to judge you. The credit rating calculation and evaluation versions vary between various loan issuers. If you have any issues about the place and how to use Https://www.johnsonclassifieds.com, you can speak to us at the web page. Similarly, credit card businesses use different strategies to check their consumer credit reports. Loan issuers might provide somebody using a high score an upper hand compared to one using a low score. If your program becomes successful, you’re incur costly rates of interest and charges. For this reason, you should watch your finances to help you avoid any issues. You can monitor your score to offer you a detailed summary of your credit score. You can retrieve a free credit report from each of the information centers for free. Grab a copy of your report and inspect the components hurting your credit score — such as fraud or errors. Start by removing the simple items before engaging in those that require legal attention. If you require a credit repair company, pick one which matches your unique requirements. Having great fiscal habits and checking your report frequently would help you stay on top of your financing.

0 comentário