The FCRA explicitly claims you could dispute any negative item on a credit report

Consumers’ appetite for failure and loans to meet their obligations brought about bankruptcies. While it may help you avoid debt, you have to comprehend the long term consequences. Bankruptcies offer you a short-term loan relief, but its consequences can go up to a decade. With bankruptcy, you won’t be able to negotiate for good quality loans or credit cards. When filing for bankruptcy, you’re experience countless challenges and legal complexities. The very first step will be expressing your inability to cover the loan and going through credit counseling. After this step, you’ll have to decide whether to file chapter 7 or chapter 13 bankruptcy. Once you pick the bankruptcy to file, you are going to have to clear all associated legal fees. Filing bankruptcy has serious consequences, hence avoiding it is an perfect choice. In case you loved this post and you would want to receive more information with regards to pop over here please visit our own web-page. Moreover, it severely damages your credit and affects how potential creditors would see you.

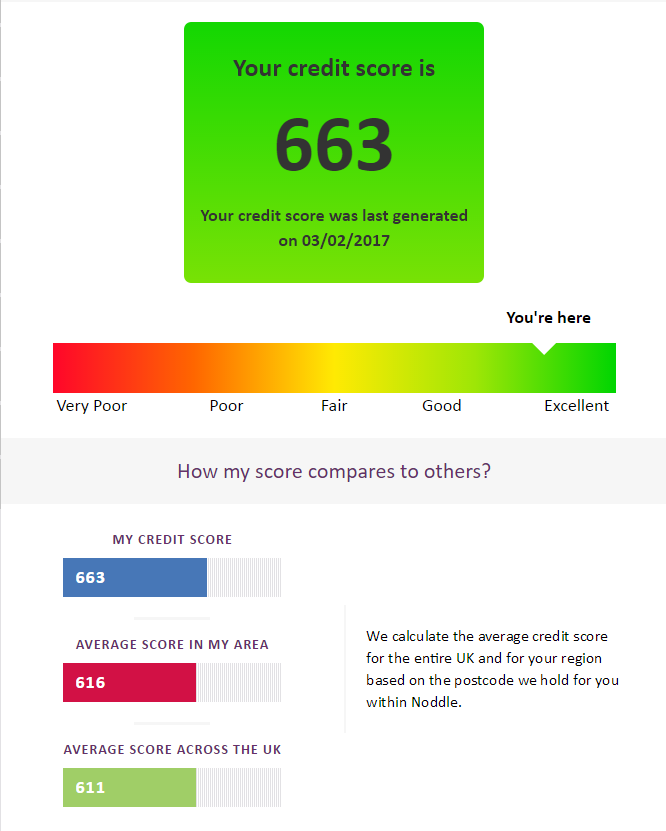

As opposed to a traditional page-by-page scrutiny, lenders frequently use your credit score to judge you. Various loan issuers utilize customer-specific models to look at their consumers’ credit reports. Besidesthey use this version because different credit card companies have different credit rating models. If you have poor credit, loan issuers will less likely approve your application. If your program becomes powerful, you’ll incur costly interest rates and fees. It is crucial to see your finances to prevent damaging your credit score and report. Checking your credit rating is an effective way of monitoring your finances. The three information centers give a free credit report to consumers each year. Retrieve your report and check the components that could damage your credit report. Before focusing on complicated items, begin by working on straightforward elements. If you might require a credit repair company, be sure to select the one which suits your needs and budget. Having good financial habits and checking your report often would help you stay on top of your finances.

In all US states, several people work so hard to make purchases with credit card. Several people narrate how hard it is to find a credit card without any issues successfully. Naturally, a credit card has a whole selection of perks and lots of drawbacks too. Before issuing you a card, credit card businesses consider several metrics prior to approving it. If you’ve got a bad credit rating and background, your chances of getting a card could be meager. After obtaining the card, you’ll need to check your spending habits, payment history, and use. If you fail to maintain good financial habits, your credit score will surely drop. Through the program, the issuer would perform a tough inquiry that would fall your credit score. The further your application flops, the further questions are added to your report. As soon as you receive the card, adhering to the strict credit regulations would function to your leverage. Failure to adhere to the standards would hurt not only your score but also pose long-term consequences.

In all US states, several people work so hard to make purchases with credit card. Several people narrate how hard it is to find a credit card without any issues successfully. Naturally, a credit card has a whole selection of perks and lots of drawbacks too. Before issuing you a card, credit card businesses consider several metrics prior to approving it. If you’ve got a bad credit rating and background, your chances of getting a card could be meager. After obtaining the card, you’ll need to check your spending habits, payment history, and use. If you fail to maintain good financial habits, your credit score will surely drop. Through the program, the issuer would perform a tough inquiry that would fall your credit score. The further your application flops, the further questions are added to your report. As soon as you receive the card, adhering to the strict credit regulations would function to your leverage. Failure to adhere to the standards would hurt not only your score but also pose long-term consequences.

One perplexing thing which most people wonder is if taking out a loan could hurt their credit score. At a glimpse, loans and how you manage them determine the score that you are going to have. Different businesses use various credit calculation models, and they can boost or reduce your credit score. Having many delinquencies would continuously plummet your credit rating. Your credit report is a snap that lenders use to ascertain whether you are creditworthy. There’s some speculation around the essence of the check since you need a loan to construct a background. If this loan program is your first one, your odds of success may be rather slim. Having said that, the association between loans is a linear chain, and you’ll need a loan to demonstrate yourself. Potential loan issuers might approve your application if you’ve cleared all your bills on time. But if you’ve got a history of defaulting, prospective lenders may question your capacity to pay. If you’ve damaged your report previously, taking out a new loan might help you restore it. The debt quantity accounts for more than 30 percent of your credit file, and you ought to pay much attention to it.

Sky blue credit is a credit repair company that was built in 1989 and is currently based in Florida. Most consumers claim that they start seeing positive outcomes after 30 days of use. Moreover, the business asserts that customers use their solutions for six months to realize full outcomes. Out of online credit ratings and tracking, many perks are linked with this company. During your membership, you are able to cancel or pause the service by contacting customer support. In addition, you can receive a refund so long as you maintain within 90 days of subscription. Without a doubt, skies blue has its own associated disadvantages — notably on the installation and credit report fees. You will pay a $39.95 retrieval fee even before commencing the credit repair process. Despite having the assurance for results, you’ll have to pay $69 to prepare the process. The sad part is you may pay for months without seeing considerable advancement on your report. Credit repair is a great investment; hence you should make your choices carefully.

0 comentário