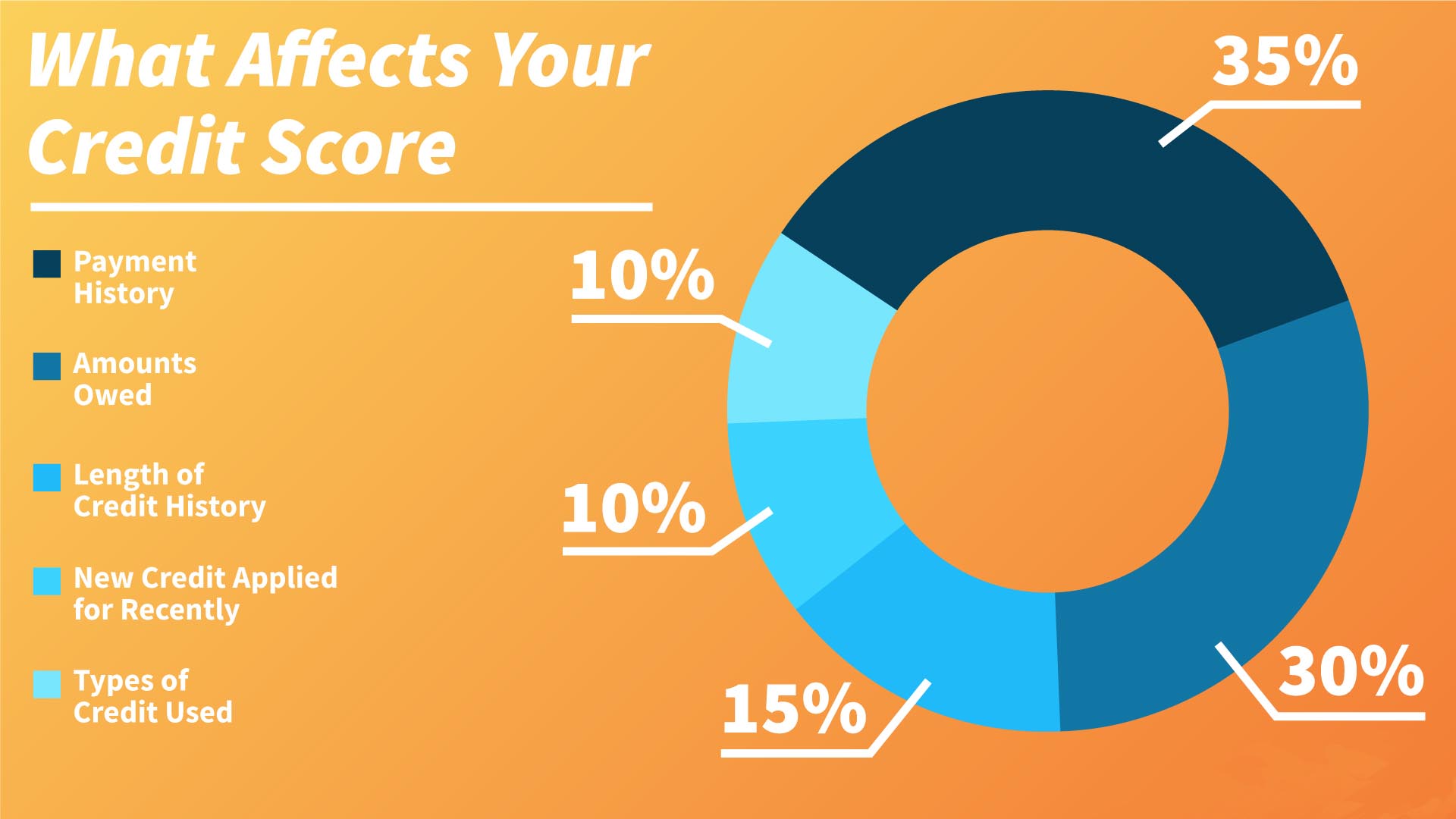

Certainly, many items can influence your credit report and tank your own score

When you have bad credit, you can almost be sure that getting a new loan is hopeless. The association between loan applications is linear; hence this scenario sounds counterintuitive. The fantastic side is you may apply for a secured credit card with bad credit. Some card issuers have been renowned for providing consumers secured credit cards even with bad credit. Mostly, you’ll need to procure a deposit which would be deducted if you fail to clear the balance. To apply for the card, you will give the essential identification and financial advice. After granting the issuer consent for a soft inquiry, you’re initiate the transaction for the deposit. Some card issuers ask for your bank account info from which they draw the deposit. No doubt, secured credit cards possess an great disparity from the conventional ones. When using a secured credit card, then you won’t utilize some attributes of an unsecured card.

Sky blue credit is a credit repair company that was built in 1989 and is based in Florida. Charge saint asserts that most customers begin seeing positive results after 30 days of use. It further argues that many customers use the service for six months for satisfaction. Sky grim credit has many benefits, including online credit ratings and tracking. If you would like to pause your service subscription, you can do so by contacting customer service. If you are not able to achieve the desired results, you can receive a refund as long as you maintain within 90 days. Like every other firm, sky blue has its own associated disadvantages, such as the installation and credit report fees. Before starting the credit repair process, you are going to have to pay $39.95 for recovery of your credit report. Moreover, you’ll be asked to pay a setup charge of $69 without a guarantee for dependable outcomes. The sad part is you may pay for months without seeing substantial progress in your report. Considering that going the process of credit repair isn’t affordable, you need to select your choices carefully.

Sky blue credit is a credit repair company that was built in 1989 and is based in Florida. Charge saint asserts that most customers begin seeing positive results after 30 days of use. It further argues that many customers use the service for six months for satisfaction. Sky grim credit has many benefits, including online credit ratings and tracking. If you would like to pause your service subscription, you can do so by contacting customer service. If you are not able to achieve the desired results, you can receive a refund as long as you maintain within 90 days. Like every other firm, sky blue has its own associated disadvantages, such as the installation and credit report fees. Before starting the credit repair process, you are going to have to pay $39.95 for recovery of your credit report. Moreover, you’ll be asked to pay a setup charge of $69 without a guarantee for dependable outcomes. The sad part is you may pay for months without seeing substantial progress in your report. Considering that going the process of credit repair isn’t affordable, you need to select your choices carefully.

Delinquencies can lose your credit score by up to 100 points. Making timely payments accounts for credit card tips a massive chunk of your report, hence defaulting can affect you. Defaulting may drop your credit rating farther, and it may be worse if it’s already low. Sometimes it’s sensible to pay late because of a job loss on an unprecedented fiscal crisis. If you had a hitch, then your loan issuer or credit card company might give you the window to stabilize. But, making late payments as a custom could affect your fiscal muscle. The loan issuers can report an overdue payment to the bureaus if you make it overdue than 30 days. Going past this window could influence your ability to get additional loans from prospective lenders. Having said that, surpassing this window would make lenders perceive you as a speculative debtor. In a nutshell, maintaining great fiscal habits and making timely payments will work to your leverage.

Delinquencies can lose your credit score by up to 100 points. Making timely payments accounts for credit card tips a massive chunk of your report, hence defaulting can affect you. Defaulting may drop your credit rating farther, and it may be worse if it’s already low. Sometimes it’s sensible to pay late because of a job loss on an unprecedented fiscal crisis. If you had a hitch, then your loan issuer or credit card company might give you the window to stabilize. But, making late payments as a custom could affect your fiscal muscle. The loan issuers can report an overdue payment to the bureaus if you make it overdue than 30 days. Going past this window could influence your ability to get additional loans from prospective lenders. Having said that, surpassing this window would make lenders perceive you as a speculative debtor. In a nutshell, maintaining great fiscal habits and making timely payments will work to your leverage.

Obtaining a traditional loan or line of credit may be daunting if you have bad credit. Although a loan is what you want to build your own credit, such a situation is certainly counterintuitive. But the excellent news is you can get a secured credit card with bad credit. Some creditors could be more willing to issue credit cards to consumers even if they have zero history. Mostly, you ought to secure a deposit which would be deducted if you are not able to clean the balance. Card issuers accumulate basic identification information and financial information from the card applicants. After granting the issuer consent for a soft query, you’ll initiate the transaction to get the deposit. In some situations, you’ll supply account information for the issuer to debit the amount directly. Of course, secured credit cards possess a huge difference from the traditional cards. Secured credit cards have some comparative downsides to an unsecured card.

Most of us pay bills — ranging from credit cards to phones, loans, and lines of credit. In case you don’t meet your financial obligations on time, creditors will make efforts to collect their money. Every collection adds to your credit report and will cripple your loan negotiation capability. At the latest FICO versions, paid collections will not hurt your score, however, unpaid ones certainly will. Your score will fall based on a few factors whether one of your account goes into collection. The impact of a collection on someone with a very low score is not as intense as in somebody with a high score. Remember that every missed payment is reported as”late payment” into the three credit bureaus. On the other hand, failure to pay the penalties will earn a collection service come for their cash. As soon as an accounts is reported a set, you will immediately experience a plummet on your own score. Since it takes a very long time to resolve a collection, making timely payments would be your ideal strategy.

The FCRA explicitly states that you can dispute any negative item on a credit report. In essence, the responsible information center needs to delete the information if it can not verify it as legitimate. Since no entity is foolproof of creating mistakes, credit information centers have some errors in consumer reports. In accordance with the FCRA, at least 20% of US taxpayers have mistaken in their credit reports. Ever since your report goes hand in hand with your score, a bad report may severely hurt your score. Since your score tells the type of consumer you’re, you should place heavy emphasis on it. In many cases, a bad score could cripple your ability to acquire favorable interest rates and quality loans. It is vital to focus on removing the negative entries from the report maintaining this element in mind. Late payments, bankruptcies, challenging inquiries, compensated collections, and fraudulent activity can impact you. Since harmful elements can harm your report seriously, you need to work on their deletion. Among the methods that work with maximum efficacy is having a credit repair business to delete the products. Most consumers involve a repair company when there are plenty of legal hoops and technicalities to maneuver. If you have any inquiries concerning where and how to make use of Credit Card Tips, you can contact us at our web site. To make certain you go through each of the steps easily, we have compiled everything you want to learn here.

0 comentário