Without doubt, there are a lot of reasons to deteriorate your credit score and credit score

There are lots of items that could affect your credit report and tank your own score. Essentially, credit repair is the process of repairing your credit by deleting the detrimental entries. Credit repair may be as simple as disputing the unwanted things with the respective bureaus. Unlike the straightforward process of disputing negative things, identity theft can be painstaking. Since fixing fraud problems involves lots of legal complexities, you may have to engage a repair company. Additionally, fraud and identity theft typically entail a series of well-choreographed criminal pursuits. Since untangling the criminal chain is a complex process, you’ll want to hire a repair business. Although some consumers have solved identity theft by themselves, a fix agency is often an ideal way. Without a doubt, many credit repair procedures involve complicated phases you’ll have to experience. In any instance, you might complete the process independently or engage a credit repair company.

In brief, your credit report entails your present financial situation and debt quantity. Ordinarily, you’ll be eligible for a typical checking account if you’ve got a good credit history. Nevertheless, you may need to think about different options if you have a bad history. A history of a checking account with another financial institution would not affect your application. If you have an overdraft, defaulting would be a guarantee that it would look in your account. However, in the event the bank turns the bill to a collection agency, the overdraft might appear. That said, you’ll find restricted scenarios when this accounts can drop your score. Some banks may check your credit report before approving your application for a checking account. The query or application to get overdraft protection could normally tank your credit score.

In brief, your credit report entails your present financial situation and debt quantity. Ordinarily, you’ll be eligible for a typical checking account if you’ve got a good credit history. Nevertheless, you may need to think about different options if you have a bad history. A history of a checking account with another financial institution would not affect your application. If you have an overdraft, defaulting would be a guarantee that it would look in your account. However, in the event the bank turns the bill to a collection agency, the overdraft might appear. That said, you’ll find restricted scenarios when this accounts can drop your score. Some banks may check your credit report before approving your application for a checking account. The query or application to get overdraft protection could normally tank your credit score.

Your credit report only entails your own debt and existential credit situation. You’ll qualify for a standard checking account when you have a fantastic credit history. If that’s not the situation, your options to get a checking account may be restricted to a second chance account. A checking account with a bank would not have any impact on you. If you don’t clear all bills in time, an overdraft would appear on your report. On the flip side, the overdraft might seem if the bank turns the sum to a set. That said, there are minimal scenarios when this account could fall your credit rating. Some financial institutions may perform a soft query when you apply for a checking account. If you sign up for overdraft protection, a checking account can affect your score.

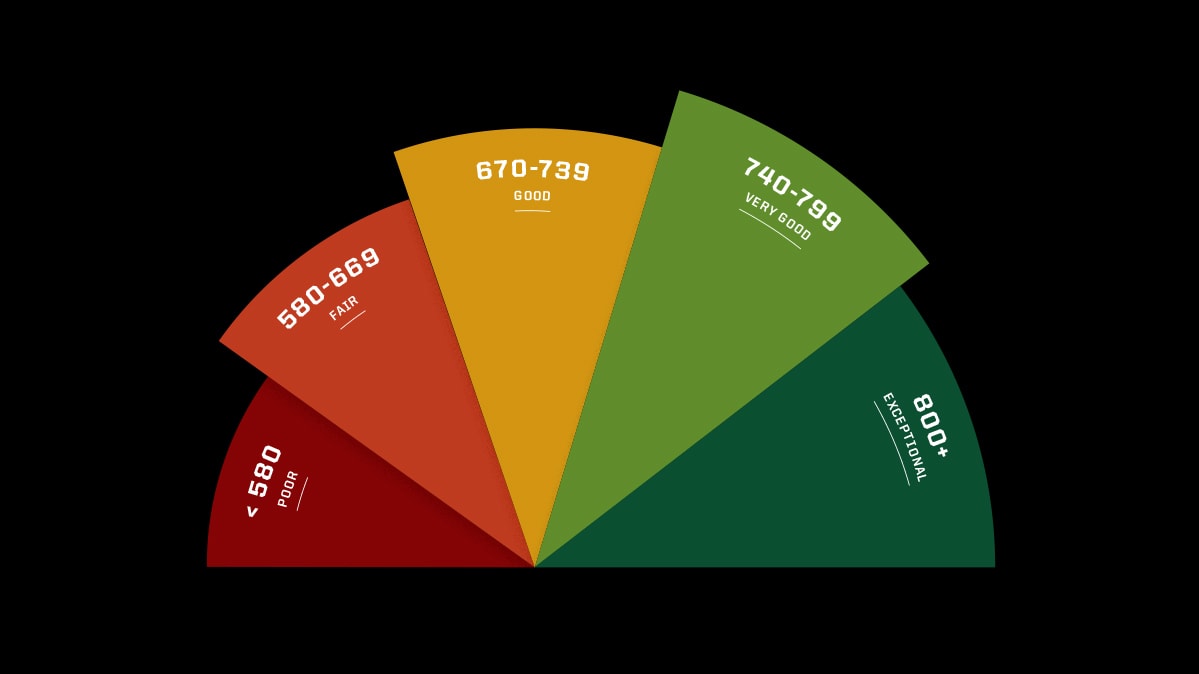

Based on the FCRA, you can dispute any negative element on your credit report. Basically, if the reporting agency can not confirm the item, it certainly has to be eliminated. Since no entity is foolproof of creating errors, credit data centers have some mistakes in customer reports. A close examination of American customers reveals that about 20 percent of them have errors in their reports. Your credit report is directly proportional to your own score, which means that a lousy report could hurt you. Because your score informs the type of customer you are, you need to place heavy emphasis on it. In many conditions, a bad credit rating can affect your ability to acquire decent quality loans. Having said that, you should operate to delete the detrimental entries from your credit report. Late payments, bankruptcies, challenging inquiries, paid collections, and fraudulent activity can affect you. Since damaging elements on a credit report may impact you, you need to try to remove them. There are distinct means of removing negative items, and among them is a credit repair company. Most customers involve a repair business whenever there are lots of legal hoops and technicalities to maneuver. To make certain you go through all the steps with ease, we have compiled everything you want to know here.

Many credit repair businesses are across the scene of credit repair. As there are plenty of generic testimonials, finding the ideal one can be an uphill task. If you’ve worked on your credit report before, you undoubtedly understand how credit repair can help. In this digitized age, you can search the world wide web to find the ideal repair options you have. Considering that the internet is filled with several repair businesses, finding the perfect one may be an intimidating job. Moreover, no one wants to spend money to get a service which has no guaranteed results. Having helped a lot of men and women resolve their credit issues, Lexington Law is a remarkably reputable firm. Arguably, staying in business for extended does not promise results, however Lexington Law provides a good deal. Lexington Law is known to be compliant with incredibly high Federal Standards. Additionally, Lexington law always keeps an impeccable success rate throughout recent years. As this company has an amazing track record, it’s undoubtedly worth to be contemplated.

0 comentário