The FCRA explicitly claims you could dispute any negative item on a credit report

Based on the FCRA’s provisions, you can retrieve and dispute any negative information in your report. The credit reporting agency is obligated to delete a disputed item that is shown to be illegitimate. Charge information facilities make a lot of mistakes — which makes such mistakes highly prevalent. The FCRA reports that approximately 1 in every 5 Americans (20%) have errors in their credit reports. Since your score depends on your report, a bad report could damage your score seriously. Since your score tells the kind of consumer you’re, you should put heavy emphasis on it. Most loan issuers turn down programs since the consumers have a poor or no credit report. Having said that, it is vital to focus on eliminating negative entries from your credit report. There are plenty of negative things which, if you do not give adequate attention, could hurt your document. Since damaging elements on a credit report can impact you, you should try to remove them. Apart from removing the entries on your own, one of the most effective methods is utilizing a repair firm. Many people use credit repair companies when they must go through lots of legal technicalities. In this piece, we’ve compiled a detailed set of steps on what you need to learn about credit repair.

Your credit report only entails your debt and existential credit situation. Mostly, you’ll qualify to operate a standard checking account if you have had a good history. If that is not the case, you may need to go to get a checking account for bad credit. A checking account with a financial institution wouldn’t have any effect on you personally. When you have an overdraft, clearing the charges on time would remove it from the report. In the event the bank turns the invoice to a collection, the overdraft might appear on the account. That said, there are restricted scenarios when this accounts can drop your score. Some banks can check your credit report before approving your application for a checking account. Should you sign up for overdraft protection, a checking account can impact your score.

Your credit report only entails your debt and existential credit situation. Mostly, you’ll qualify to operate a standard checking account if you have had a good history. If that is not the case, you may need to go to get a checking account for bad credit. A checking account with a financial institution wouldn’t have any effect on you personally. When you have an overdraft, clearing the charges on time would remove it from the report. In the event the bank turns the invoice to a collection, the overdraft might appear on the account. That said, there are restricted scenarios when this accounts can drop your score. Some banks can check your credit report before approving your application for a checking account. Should you sign up for overdraft protection, a checking account can impact your score.

Sky blue credit is a credit repair firm that was built in 1989 and is headquartered in Florida. Customers using credit saint to fix credit claim they begin seeing positive progress following 30 days. Moreover, the company asserts that clients use their solutions for just six months to realize complete outcomes. Out of online credit ratings and tracking, many perks are linked with this corporation. In the duration of your subscription, you can pause the subscription by contacting customer support. Additionally, you can get a refund so long as you maintain within 90 days of subscription. Besides the advantages, skies blue has some related downsides too. You’ll cover a $39.95 recovery fee even before commencing the credit repair procedure. Despite not having the assurance for results, you’ll have to pay $69 to set up the process. Quite simply, you can pay for months without seeing a substantial increase in your score. Since repairing credit demands some significant investment, you must make your choices carefully.

Sky blue credit is a credit repair firm that was built in 1989 and is headquartered in Florida. Customers using credit saint to fix credit claim they begin seeing positive progress following 30 days. Moreover, the company asserts that clients use their solutions for just six months to realize complete outcomes. Out of online credit ratings and tracking, many perks are linked with this corporation. In the duration of your subscription, you can pause the subscription by contacting customer support. Additionally, you can get a refund so long as you maintain within 90 days of subscription. Besides the advantages, skies blue has some related downsides too. You’ll cover a $39.95 recovery fee even before commencing the credit repair procedure. Despite not having the assurance for results, you’ll have to pay $69 to set up the process. Quite simply, you can pay for months without seeing a substantial increase in your score. Since repairing credit demands some significant investment, you must make your choices carefully.

Your credit report only entails your debt and existential credit situation. You will be eligible for a typical checking account if you’ve got a fantastic credit history. When you have a terrible history, you may have to think about second chance checking account. If you have any type of inquiries regarding where and exactly how to utilize Credit Tricks, you can contact us at the webpage. When you have a checking account with a bank, its transactions will not affect you. Unless you clear all bills on time, an overdraft would show up on your account. But in the event the bank turns the bill to a collection agency, the overdraft might seem. That said, there are minimal situations when this accounts could fall your credit rating. Through application, some banks may perform a soft inquiry on your credit report. Primarily two elements can drop your credit score — a tough inquiry and overdraft protection.

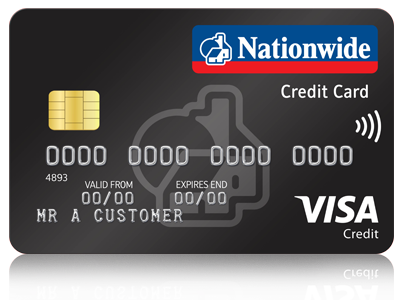

Without a doubt, using a credit card is remarkably prestigious across the US. Undeniably, almost everyone in the US functions to get financial freedom using a credit card. Like every other solution, a credit card includes a wide assortment of advantages and associated cons. First off, credit card issuers look at your score prior to issuing you credit card. This implies that having a poor credit score will undoubtedly influence your application’s success. In addition, you’ll have to maintain good financial habits following a successful card application. If you go past the 30% credit utilization limit, your credit rating would undoubtedly drop. Besides, sending your program authorizes the issuer to execute a hard question which affects your score. The more your application flops, the further inquiries are added to a report. Once you receive the card, then adhering to the strict credit regulations will work to your leverage. If you are not able to adhere to the regulations, then you’ll experience long-term consequences on your report.

Sky blue credit is a credit repair firm that was constructed in 1989 and is currently headquartered in Florida. Clients using credit saint to repair credit claim they start seeing positive advancement following 30 days. The company argues that most customers use the service after six weeks to get complete satisfaction. When using sky blue charge, you’ll definitely benefit from a gigantic of its related advantages. In the course of your subscription, you can pause the subscription by contacting customer service. Additionally, you can receive a refund so long as you maintain within 90 days of subscription. Without a doubt, skies blue has some drawbacks, especially on the setup and credit report fees. You will cover a $39.95 retrieval fee even before beginning the credit repair procedure. Besides, you’ll have to pay $69 to start the procedure though you won’t have a guarantee for Credit Tricks results. You can renew your subscription for weeks without seeing a substantial amount of progress. Credit repair is a great investment; hence you should make your choices carefully.

0 comentário