There are lots of items which can influence your credit report and tank your own score

In case your program was unsuccessful, you could open another chance checking account. In case you loved this article and you wish to receive more information about Gsalesstaging.wpengine.com kindly visit our own internet site. Second chance checking account work if you have been unsuccessful on your credit application previously. The bank would check your documents against ChexSystems before entrusting your application. ChexSystems is an entity to which banks report poor credit behaviour. Appearing on ChexSystems means you don’t have a previously excellent credit history. This means that in the event that you have a faulty history, your success rate will undoubtedly be slim. Some credit unions and banks provide this second opportunity accounts that will assist you repair credit. However, there’s a disparity between these accounts along with a typical checking accounts. Like every other solution, second chance checking account have advantages and disadvantages. While you can use second chance checking accounts to reconstruct credit, they generally have high prices. Besides, you can not enroll in an overdraft program since the account shows your financial discipline. Despite those drawbacks, instant opportunity accounts are better compared to secured credit cards or check-cashing.

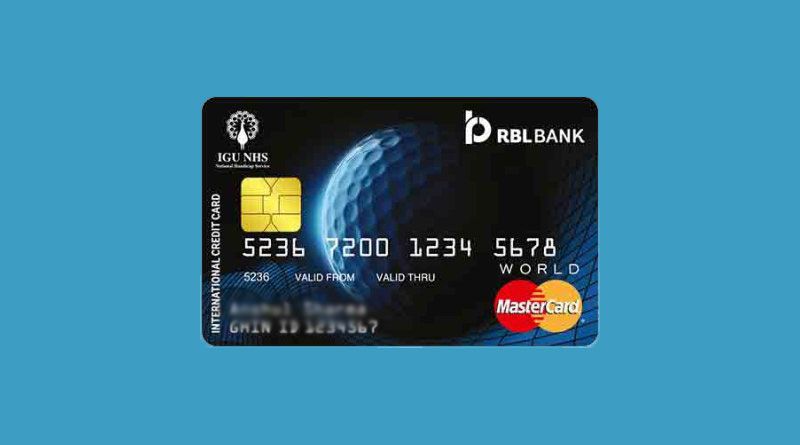

Certainly, having a credit card is incredibly prestigious across the united states. Several people narrate how hard it’s to get a credit card without any issues successfully. As you will certainly enjoy the perks of this card, the disadvantages are inevitable. Before issuing you a card, charge card businesses consider several metrics before approving it. This implies that having a poor credit rating would undoubtedly affect your application’s success. You’ll have to take into account your spending habits, usage, and obligations after getting the card. Habits like defaulting, surpassing the charge utilization limit would impact your credit score and report. Moreover, the application adds a hard inquiry for your account, which surely tanks your score. The more your program flops, the further questions are added to your report. Once you receive the card, adhering to the strict credit regulations will work to your leverage. Failure to obey the regulations would tank your credit rating and damage your report.

Certainly, having a credit card is incredibly prestigious across the united states. Several people narrate how hard it’s to get a credit card without any issues successfully. As you will certainly enjoy the perks of this card, the disadvantages are inevitable. Before issuing you a card, charge card businesses consider several metrics before approving it. This implies that having a poor credit rating would undoubtedly affect your application’s success. You’ll have to take into account your spending habits, usage, and obligations after getting the card. Habits like defaulting, surpassing the charge utilization limit would impact your credit score and report. Moreover, the application adds a hard inquiry for your account, which surely tanks your score. The more your program flops, the further questions are added to your report. Once you receive the card, adhering to the strict credit regulations will work to your leverage. Failure to obey the regulations would tank your credit rating and damage your report.

Defaulting can damage your credit report and drop your credit score significantly. The reason for the fact is that on-time payments contribute considerably to your credit report. Your credit score could always plummet in the event that you already have a significantly low score. If a unprecedented circumstance comes your way, making late payments could be clear. If your difficulty is explainable, some loan issuers could provide you room to make the payment. However, making late payments as a habit could influence your muscle. The national law expressly states that loan issuers can’t report a late payment; it isn’t older than 30 days. Exceeding this window will affect your ability to borrow loans or bargain favorable interest rates. The reason behind this variable is the fact that potential lenders would consider you a high-risk borrower. On a concluding note, making timely payments will function to your leverage.

Defaulting can damage your credit report and drop your credit score significantly. The reason for the fact is that on-time payments contribute considerably to your credit report. Your credit score could always plummet in the event that you already have a significantly low score. If a unprecedented circumstance comes your way, making late payments could be clear. If your difficulty is explainable, some loan issuers could provide you room to make the payment. However, making late payments as a habit could influence your muscle. The national law expressly states that loan issuers can’t report a late payment; it isn’t older than 30 days. Exceeding this window will affect your ability to borrow loans or bargain favorable interest rates. The reason behind this variable is the fact that potential lenders would consider you a high-risk borrower. On a concluding note, making timely payments will function to your leverage.

There are several credit repair firms in this landscape. Since there are lots of generic testimonials, locating the perfect one can be an uphill task. If you have worked on your own credit report earlier, you definitely know how credit repair might help. In this age, you are able to search the world wide web to obtain the perfect repair options you have. In a glance, you’ll observe that choosing from the countless repair businesses on the internet can be difficult. Moreover, you would not wish to spend funds on a business without a good history. Having helped many men and women solve their credit issues, Lexington Law is a remarkably reputable firm. Whilst staying in the scene for extended doesn’t guarantee favorable results, this firm has over that. Legally, this company has turned out to maintain stringent Federal criteria in this a heavily-monitored scene. Moreover, it has sustained a favorable history through the years. As one of those high-rated credit repair businesses, Lexington Law is definitely worth your consideration.

Dependent on the FCRA’s provisions, it is possible to retrieve and dispute any negative information on your document. Essentially, if the reporting agency can not verify the item, it surely must be eliminated. Like every other thing, credit information centers tend toward making lots of mistakes, particularly in a credit report. The FCRA asserts that close to one in every five Americans have errors in their reports. Your credit report depends on your score, and a bad score could seriously plummet your credit rating. Moreover, your score determines your creditworthiness — for any standard or lines of credit loan. Most loan issuers turn down programs since the customers have a poor or no credit score report. Having said that, you should work to delete the detrimental entries in the credit report. Several negative entries on your credit report may cripple your ability to acquire good quality loans. Since damaging things can affect you badly, you should work on removing them from your report. Besides removing the entries by yourself, among the very best ways is using a repair company. Many consumers opt to utilize a repair business when they recognize they can not go through all hoops. Since credit repair can be a daunting process, we’ve compiled everything you need to learn here.

0 comentário