The FCRA explicitly states that you can dispute any negative item on a credit report

Your chances of success in getting a new loan will be slim if you have bad credit. The relationship between loan software is linear; therefore this scenario seems counterintuitive. The fantastic side is that you can apply for a secured credit card with bad credit. Some card issuers are renowned for providing consumers secured credit cards even with bad credit. Basically, you are going to have to place a deposit which functions as security in the event the equilibrium goes unpaid. Through the application, you’ll need to give your basic identification information and Credit Card Tips financial information. As the card issuer checks your credit report, you’ll start calculating the collateral. Some card issuers request your bank account info where they draw the deposit. Of course, secured credit cards have a huge difference from the traditional cards. Despite all these gaps, you’ll undoubtedly benefit from some of its advantages.

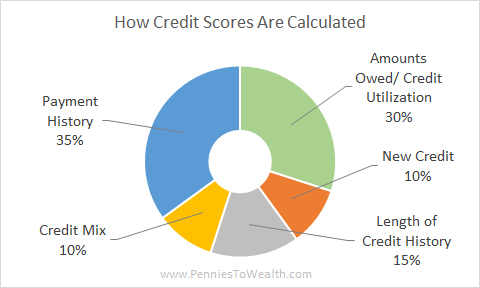

Round the united states, with a credit card continues being one of the most efficient fiscal tools. Countless consumer tales point towards moving through huge hurdles to acquiring one. Of course, a credit card has its related perks and a few disadvantages too. Through program, credit card issuers look at several metrics before approving your card application. In other words, having a low credit score would practically guarantee a flopped program. You’ll need to take into account your spending habits, usage, and obligations after getting the card. If you go past the 30% credit usage limitation, your credit rating would undoubtedly drop. Besides, sending your application authorizes the issuer to perform a hard question which affects your score. The further you’ve failed software, the more inquiries you’ll have on your report. In regards to using the card, many issuers adhere to high regularity standards. Failure to obey the regulations would tank your credit rating and damage your report.

According to the FCRA, you can dispute any unwanted element on your credit report. The credit reporting bureau is bound to delete a disputed item that’s shown to be illegitimate. Charge information facilities make a lot of mistakes — making such mistakes highly prevalent. The FCRA asserts that close to one in every five Americans have errors in their reports. Since your report goes together with your score, a lousy report may severely damage your score. Your score dictates your creditworthiness in any credit card application of traditional loans. In many conditions, a bad credit score can influence your ability to acquire good quality loans. Having said that, you should work to delete the detrimental entries in the credit report. There are plenty of negative items which, if you do not give sufficient attention, could damage your document. Since negative components on a credit report can impact you, you should try to remove them. When you loved this short article along with you would like to get details about Credit card tips i implore you to go to the web page. Among the ways that work with maximum efficiency is having a credit repair company to delete the items. Most people use credit repair businesses when they have to go through plenty of legal technicalities. In this guide, we’ve collated whatever you need to know about credit restoration.

According to the FCRA, you can dispute any unwanted element on your credit report. The credit reporting bureau is bound to delete a disputed item that’s shown to be illegitimate. Charge information facilities make a lot of mistakes — making such mistakes highly prevalent. The FCRA asserts that close to one in every five Americans have errors in their reports. Since your report goes together with your score, a lousy report may severely damage your score. Your score dictates your creditworthiness in any credit card application of traditional loans. In many conditions, a bad credit score can influence your ability to acquire good quality loans. Having said that, you should work to delete the detrimental entries in the credit report. There are plenty of negative items which, if you do not give sufficient attention, could damage your document. Since negative components on a credit report can impact you, you should try to remove them. When you loved this short article along with you would like to get details about Credit card tips i implore you to go to the web page. Among the ways that work with maximum efficiency is having a credit repair company to delete the items. Most people use credit repair businesses when they have to go through plenty of legal technicalities. In this guide, we’ve collated whatever you need to know about credit restoration.

Everyone makes bill payments — from loans to credit cards and lines of credit. If you don’t meet your financial obligations on time, lenders will make efforts to collect their money. Whenever a collection service makes efforts to regain the money, it adds to a report for a collection. Based on FICO, unpaid collections would affect one more than paid groups. When one of your accounts gets recovered by agencies, your score falls based on several variables. There is a disparity at a collection’s effect on someone using a high score and one with a low score. Missing a payment will make your loan issuer report it as”late payment” to the three bureaus. Failing to repair your account’s bad condition would earn a collection agency come for their cash. Your credit score will start dropping after your accounts goes into collection. Since it takes a very long time to work out a collection, making timely payments is the ideal strategy.

In case you decide to call for a repair company, Credit Saint may be your ideal choice. It’s among the few institutions using an A+ BBB score; therefore it has plenty to give. Credit Saint has helped consumers resolve credit issues for more than a decade consequently has a fantastic track record. One significant element is how Credit Saint educates consumers about different charge problems. Besides, it’s three bundles — Polish, Clean Slate, and Credit Remodel — where you select. As you move about the process, the legal staff would prepare dispute letters to suit your particular requirements. If you’re not entirely satisfied, you are going to be able to receive a refund within 90 days of program. Regardless of the mammoth of benefits, credit saint has several related disadvantages also. Credit saint has significantly high setup fees and has limited availability. If you are residing in South Carolina, you may have to look for the assistance of other service providers.

0 comentário