The FCRA explicitly claims you could dispute any negative item on a credit report

If you have bad credit, you can almost make positive that acquiring a new loan is impossible. The relationship between loan software is linear; therefore this situation seems counterintuitive. However, the excellent news is you can find a secured credit card with bad credit. Some card issuers have been renowned for giving customers secured credit cards even with bad credit. The card issuer will expect you to pay some amount for a deposit when applying for the card. Through the application, you’ll need to give your basic identification information and financial details. As the card issuer checks your credit report, you’ll start processing the security. Some card issuers also ask for your bank account info from which they withdraw the deposit. No doubt, guaranteed credit cards have an enormous disparity from the conventional ones. A secured credit card has a few differences from a normal one, but you’ll gain from some perks.

Federal bankruptcy courts came up with insolvency to reduce significant financial burdens on people. Filing bankruptcy might offset some debt from you, but you need to understand some consequences. You may have a temporary relief if you file for bankruptcy, but its effects can last for a couple of years. It also might cripple your ability to negotiate favorable rates of interest. When filing for bankruptcy, you’ll experience countless hurdles and legal complexities. You will want to show your inability to pay the loan and go through credit counseling ahead. After counseling, you’ll choose the bankruptcy category to document: chapter 7 or chapter 13. Whichever the category you choose, you’ll have to pay court charges and attorney fees. Filing bankruptcy has severe consequences, hence avoiding it is an perfect option. Besides, a bankruptcy tanks your credit rating and paints you as not creditworthy.

Most of us pay invoices — ranging from bank cards to loans, phones, and lines of credit. Fundamentally, loan issuers would come for their money if you don’t make payments on time. Whenever a collection service makes efforts to recover the cash, it provides to your report as a collection. The latest FICO calculation model points to how unpaid collections would affect your score. When one of your accounts gets recovered by agencies, your score falls predicated on some variables. When you have a high score, you’ll lose more things than someone with few points, and the converse is true. Remember that every missed payment is reported as”late payment” into the three credit bureaus. Failing to fix your account’s poor condition would earn a collection service come for their cash. Your credit score will begin falling after your account goes into collection. Resolving a set is a painstaking procedure, hence making timely payments is always an ideal way.

Most of us pay invoices — ranging from bank cards to loans, phones, and lines of credit. Fundamentally, loan issuers would come for their money if you don’t make payments on time. Whenever a collection service makes efforts to recover the cash, it provides to your report as a collection. The latest FICO calculation model points to how unpaid collections would affect your score. When one of your accounts gets recovered by agencies, your score falls predicated on some variables. When you have a high score, you’ll lose more things than someone with few points, and the converse is true. Remember that every missed payment is reported as”late payment” into the three credit bureaus. Failing to fix your account’s poor condition would earn a collection service come for their cash. Your credit score will begin falling after your account goes into collection. Resolving a set is a painstaking procedure, hence making timely payments is always an ideal way.

The FCRA explicitly states you could dispute any negative item on a credit report. The credit reporting agency is bound to delete a disputed item that is found to be illegitimate. Like any other entity, credit data centers tend toward making a great deal of errors, especially in a credit report. The FCRA reports that roughly 1 in every 5 Americans (20 percent ) have errors in their credit reports. Since your report goes hand in hand with your score, a bad report may severely damage your score. Since your score tells the kind of customer you’re, you should place heavy emphasis on it. Most loan issuers turn down applications since the customers have a bad or no credit report. It’s vital to work on removing the negative entries from your report maintaining this factor in mind. Late payments, bankruptcies, challenging questions, paid collections, and fraudulent activity can affect you. Since damaging items can affect you badly, you need to work on eliminating them from your report. You’re able to eliminate the negative items on your own or involve a credit repair firm. Many consumers opt to utilize a repair company when they realize they can’t undergo all hoops. To make certain you go through all the steps easily, we have compiled everything you want to know here.

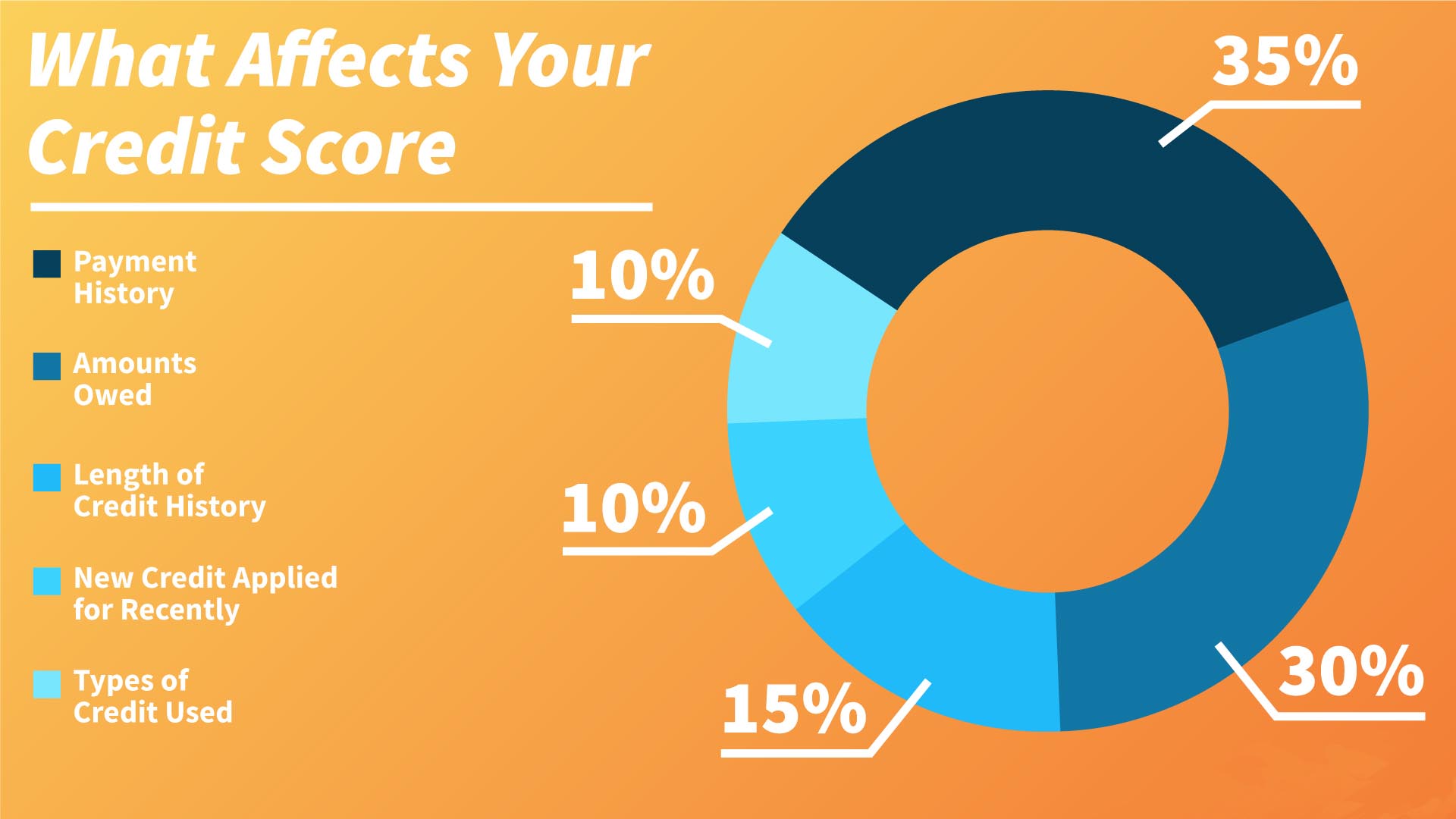

Your credit rating is a credit picture with which lenders use to judge your creditworthiness. Various loan issuers use customer-specific models to look at their consumers’ credit reports. Additionally, credit card firms also use tailored strategies when checking a credit report. If you cherished this article and you also would like to collect more info pertaining to official statement nicely visit our own web-site. Your program will less likely succeed when you have a bad credit score and report. In rare scenarios, your application would be successful, but you’ll incur expensive fees. It’s crucial to see your finances to prevent damaging your credit score and Credit Score report. Checking your credit rating often would give you a very clear summary of your fiscal well-being. The 3 information centers give a free credit report to consumers each year. Retrieve your account and check the components that could hurt your credit report. You should start working on the simple things before involving paralegals in taking away the complex ones. If you might need a credit repair firm, be sure to pick the one which suits your requirements and budget. Always make sure you keep good financial habits and assess your report often.

0 comentário