Primarily, several things could be detrimental to your credit report and tank your credit rating

Mostly, several things could be harmful to your credit report and tank your credit rating. In brief, credit repair is the process of enhancing your credit by deleting the negative entries. In some cases, deleting the unwanted entries might be as straightforward as disputing the things with the agencies. Unlike the simple procedure for disputing negative things, identity theft can be painstaking. For a walkabout for this daunting process, you are going to have to engage a repair company to prevent complexities. Besides, fraud and identity theft usually involve a series of well-connected criminal pursuits. In case you don’t hire a credit repair firm, unraveling these connections may prove useless. Though some consumers have solved identity theft on their own, a repair agency is often an perfect way. Admittedly, deleting negative entries entails a mammoth of complexities and legal technicalities. In whichever situation, involving a fix business or working on your own may be fruitful.

Across the united states, using a credit card proceeds being one of the most efficient fiscal instruments. Without a doubt, nearly everyone in the US functions to get financial freedom using a credit card. Like every other product, a credit card has a whole range of advantages and associated cons. During program, credit card issuers look at many metrics before approving your own card software. This implies that using a bad credit score would undoubtedly influence your application’s success. Besides, you’ll need to see a couple of things as soon as you get your card. Habits like defaulting, surpassing the credit use limit would impact your credit report and score. Besides, the program adds a hard inquiry to your account, which surely tanks your own score. If you make several unsuccessful applications, several inquiries could be added to your report. Several issuing firms have incredibly substantial regulations that govern card usage and utilization. In case you don’t stick to the strict regulations, then you’ll undoubtedly get influenced by the consequences.

Mostly, several items could be harmful to your credit report and tank your credit score. Primarily, credit fix involves repairing your credit by deleting the harmful items. In some cases, deleting the negative entries might be as simple as disputing the items with the agencies. In case you’re a victim of fraud or identity theft, you may need to hire a credit repair firm. Since fixing fraud problems involves lots of legal complexities, you might need to hire a repair company. Besides, fraud and identity theft typically involve a chain of well-connected criminal activities. Without a doubt, unraveling these chains can be an uphill task if you do it all on your own. Though some customers have finished the procedure by themselves, a repair company would be perfect. Admittedly, deleting negative entrances involves a massive of complexities and legal technicalities. However, you can successfully lodge a dispute and complete the process by yourself or use a repair service.

Mostly, several items could be harmful to your credit report and tank your credit score. Primarily, credit fix involves repairing your credit by deleting the harmful items. In some cases, deleting the negative entries might be as simple as disputing the items with the agencies. In case you’re a victim of fraud or identity theft, you may need to hire a credit repair firm. Since fixing fraud problems involves lots of legal complexities, you might need to hire a repair company. Besides, fraud and identity theft typically involve a chain of well-connected criminal activities. Without a doubt, unraveling these chains can be an uphill task if you do it all on your own. Though some customers have finished the procedure by themselves, a repair company would be perfect. Admittedly, deleting negative entrances involves a massive of complexities and legal technicalities. However, you can successfully lodge a dispute and complete the process by yourself or use a repair service.

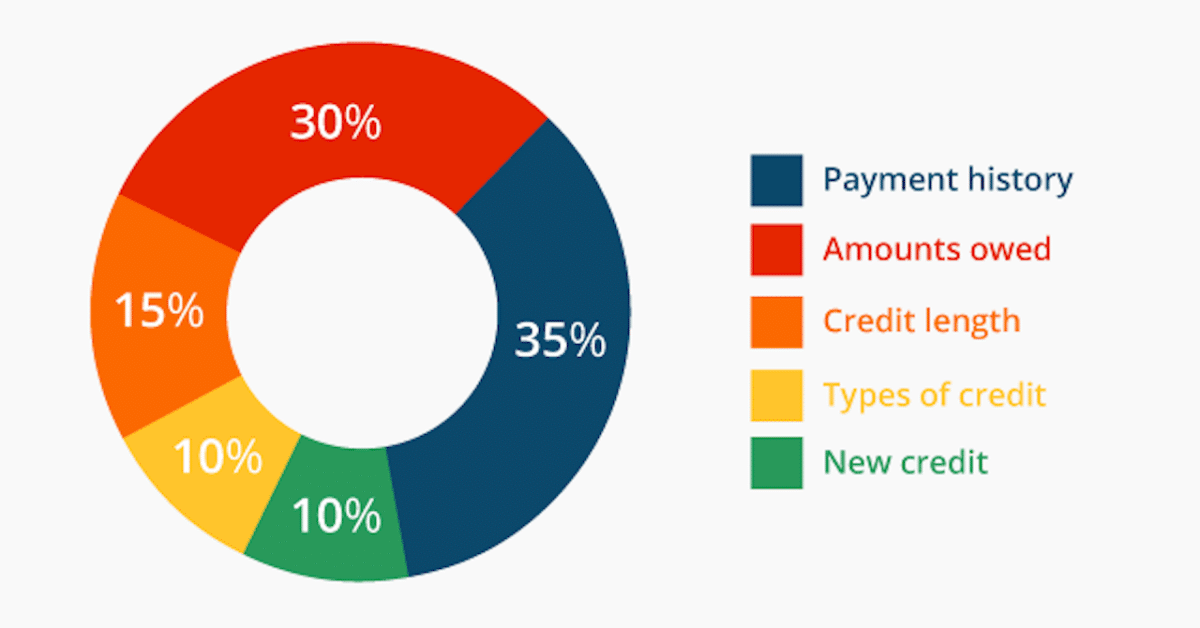

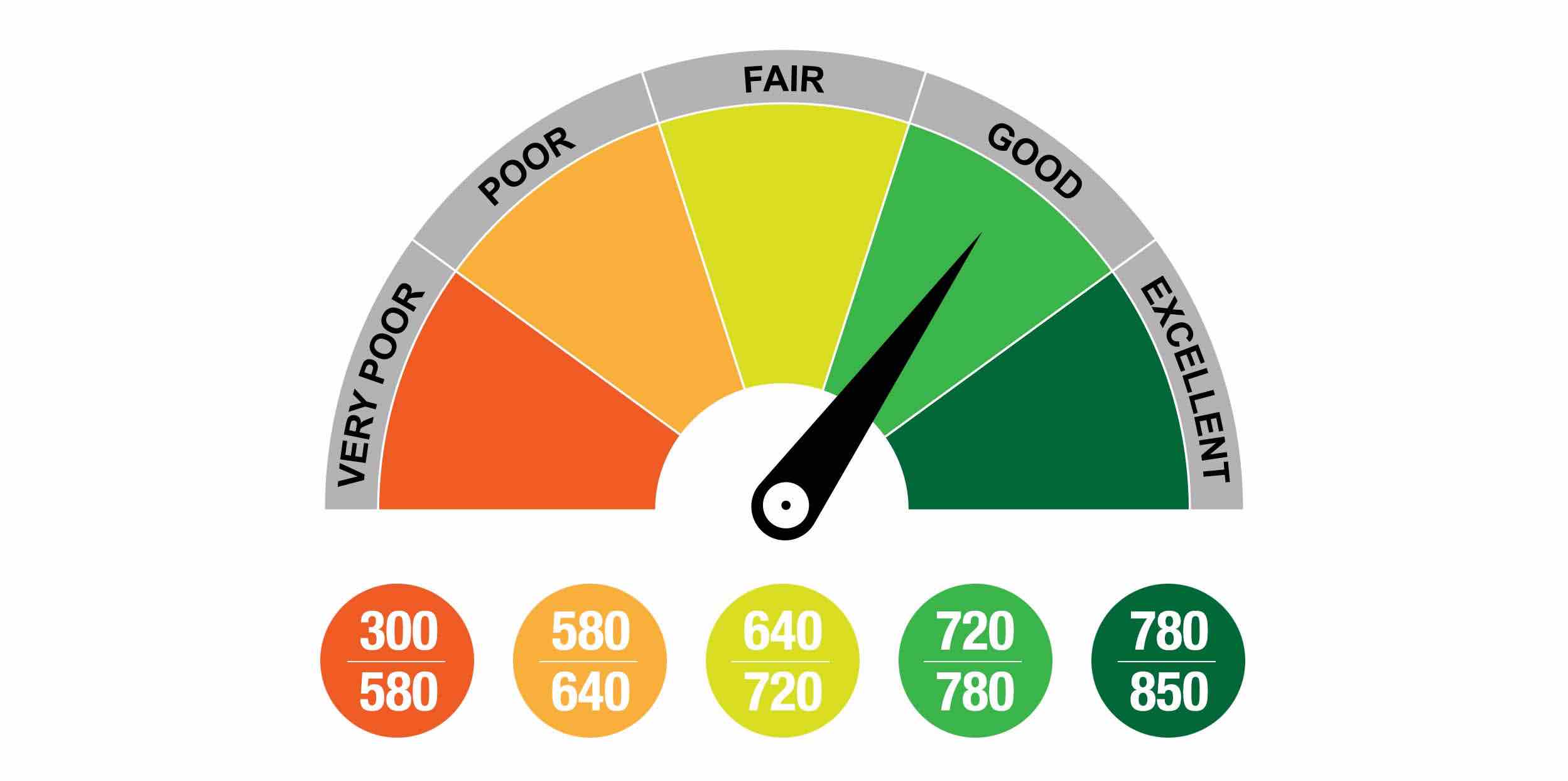

If you loved this article and you would like to receive extra info with regards to Credit Rates kindly check out our internet site. According to the FCRA, it is possible to dispute any negative element in your credit report. Primarily, if the credit bureau can not confirm the information, it has to delete it. Credit information facilities make a lot of mistakes — which makes such errors highly prevalent. The FCRA reports that approximately 1 in every 5 Americans (20%) have errors in their credit reports. Your credit report is directly proportional to your score, which means that a lousy report could hurt you. Since your score informs the type of customer you’re, you should place heavy emphasis on it. Most loan issuers turn down programs since the customers have a bad or no credit score report. Having said that, you should work to delete the harmful entries in the credit report. Late payments, bankruptcies, hard inquiries, compensated collections, and fraudulent activity can impact you. Because harmful elements can harm your report severely, you should work on their deletion. Apart from removing the entries on your own, among the most effective methods is utilizing a repair firm. As this procedure involves lots of technical and legalities, most people opt for having a repair firm. Because credit repair can be an overwhelming process, we have compiled everything you need to learn here.

If you loved this article and you would like to receive extra info with regards to Credit Rates kindly check out our internet site. According to the FCRA, it is possible to dispute any negative element in your credit report. Primarily, if the credit bureau can not confirm the information, it has to delete it. Credit information facilities make a lot of mistakes — which makes such errors highly prevalent. The FCRA reports that approximately 1 in every 5 Americans (20%) have errors in their credit reports. Your credit report is directly proportional to your score, which means that a lousy report could hurt you. Since your score informs the type of customer you’re, you should place heavy emphasis on it. Most loan issuers turn down programs since the customers have a bad or no credit score report. Having said that, you should work to delete the harmful entries in the credit report. Late payments, bankruptcies, hard inquiries, compensated collections, and fraudulent activity can impact you. Because harmful elements can harm your report severely, you should work on their deletion. Apart from removing the entries on your own, among the most effective methods is utilizing a repair firm. As this procedure involves lots of technical and legalities, most people opt for having a repair firm. Because credit repair can be an overwhelming process, we have compiled everything you need to learn here.

Bankruptcies were created by Federal Bankruptcy courts to cancel huge debts from consumers. Filing bankruptcy might offset some debt from you, but you need to know several consequences. You may have a temporary relief if you file for bankruptcy, but its effects may last for a decade. Besides, a bankruptcy could cripple your negotiating power for favorable rates of interest or credit cards. In the class of filing a bankruptcy, you’ll need to go through several legal hoops and challenges. The very first step will be expressing your inability to cover the loan and going through credit counseling. After counseling, you are going to choose the bankruptcy category to document: chapter 7 or chapter 13. Whichever the case, you’ll pay the associated fees — both court charges and attorney fees. Since you’ll lose much more than you gain, avoiding filing for bankruptcy is an perfect option. Filing bankruptcy affects the perspective with which lenders see you, hence you should avoid it.

0 comentário