The FCRA explicitly states that you can dispute any negative item on a credit report

We all pay invoices — ranging from credit cards to phones, loans, and lines of credit. But if you do not make timely payments, loan issuers would come for their possessions. Generally speaking, such attempts, also known as sets, can have a negative impact on your credit score. Based on FICO, outstanding collections will affect you more than paid collections. Your score will drop based on a few factors if one of your accounts goes into group. There is a disparity in a collection’s effect on someone with a high score and one using a low score. If you miss a payment, your creditor would report it to the agencies as”payment” In case you don’t restore your account from its bad state, you could experience a set. Immediately you experience a set; your credit score would fall drastically. Considering deleting a collection takes a lot of money and time, making timely payments would be the ideal strategy.

Using Credit Saint to cure broken credit could be an perfect alternative for you. It is one of the few institutions using an A+ BBB score; therefore it has plenty to offer. As a reputable company that has worked for close to 15 decades, Credit Saint is one of the highest-ranked. One of the best perks of Credit Saint is how it educates consumers about various credit issues. Moreover, it’s three bundles — Polish, Clean Slate, and Credit Remodel — where you select. When preparing the dispute letters, then the legal staff would use tailored letters to fit your specific requirements. If you’re not entirely satisfied, you are going to be able to be given a refund within 90 days of program. Besides all the perks of the company, credit saint has a few disadvantages. From high setup fees to restricted availability, credit saint has a few related downsides. Across the usa, charge saint is offered in all countries except South Carolina.

Getting a conventional loan or line of credit may be daunting if you have poor credit. The association between loan applications is linear; therefore this scenario sounds counterintuitive. The fantastic side is that you can apply for a secured credit card with poor credit. You can find a card issuer who is prepared to give you a credit card after securing some deposit. The way it works is that you put a deposit to function as collateral in the event you don’t pay the balance. To apply for the card, you will give the necessary identification and financial information. The second step is allowing the issuer to perform a soft inquiry, after that you begin paying the deposit. Some card issuers also request your bank account information from which they withdraw the deposit. Of course, secured credit cards have a massive difference from the conventional cards. When using a secured credit card, then you won’t use some attributes of an unsecured card.

Certainly, having a credit card is incredibly prestigious across the united states. Countless consumer accounts tip for their unbowed efforts to obtaining a credit card. While you’ll surely enjoy the perks of this card, the disadvantages are unavoidable. Through program, credit card issuers appear at several metrics before approving your card software. If you have a poor credit rating and history, your chances of obtaining a card could be meager. Additionally, you’ll need to maintain good financial habits after having a thriving card program. If you have any queries relating to where and how to use Play.Google.com, you can contact us at our internet site. Should you exceed the 30% utilization threshold or default in your payments, your credit score will fall. Additionally, the program adds a tricky inquiry for Credit Rates your report, which also impacts your score. The more your application flops, the further inquiries are added to your report. As soon as you receive the card, then adhering to the stringent credit regulations will work to your leverage. If you are not able to stick to the regulations, then you’ll experience long-term consequences on your report.

Certainly, having a credit card is incredibly prestigious across the united states. Countless consumer accounts tip for their unbowed efforts to obtaining a credit card. While you’ll surely enjoy the perks of this card, the disadvantages are unavoidable. Through program, credit card issuers appear at several metrics before approving your card software. If you have a poor credit rating and history, your chances of obtaining a card could be meager. Additionally, you’ll need to maintain good financial habits after having a thriving card program. If you have any queries relating to where and how to use Play.Google.com, you can contact us at our internet site. Should you exceed the 30% utilization threshold or default in your payments, your credit score will fall. Additionally, the program adds a tricky inquiry for Credit Rates your report, which also impacts your score. The more your application flops, the further inquiries are added to your report. As soon as you receive the card, then adhering to the stringent credit regulations will work to your leverage. If you are not able to stick to the regulations, then you’ll experience long-term consequences on your report.

Most people continually wonder whether taking a new loan could hurt their credit. Primarily, how you handle loans is an essential part in determining your credit score. Because credit calculation versions are generally complicated, loans can either tank or boost your credit rating. Having many delinquencies would continuously plummet your credit rating. When issuing loans, lenders use your credit rating to determine the type of customer you are. Since you need a loan to build a comprehensive history, this component may be counterintuitive. Quite simply, if you did not have a loan in the past, your success rate might be rather minimal. That said, you are going to need a loan and a good credit utilization ratio to qualify for one. Potential loan issuers might accept your application if you have cleared all your accounts on time. On the contrary, your program would flop if you have a history of defaulting. If you’ve damaged your report previously, taking a new loan might help you reestablish it. Since the amount of debt carries a huge chunk of your report (30 percent ), you should pay utmost attention to it.

Most people continually wonder whether taking a new loan could hurt their credit. Primarily, how you handle loans is an essential part in determining your credit score. Because credit calculation versions are generally complicated, loans can either tank or boost your credit rating. Having many delinquencies would continuously plummet your credit rating. When issuing loans, lenders use your credit rating to determine the type of customer you are. Since you need a loan to build a comprehensive history, this component may be counterintuitive. Quite simply, if you did not have a loan in the past, your success rate might be rather minimal. That said, you are going to need a loan and a good credit utilization ratio to qualify for one. Potential loan issuers might accept your application if you have cleared all your accounts on time. On the contrary, your program would flop if you have a history of defaulting. If you’ve damaged your report previously, taking a new loan might help you reestablish it. Since the amount of debt carries a huge chunk of your report (30 percent ), you should pay utmost attention to it.

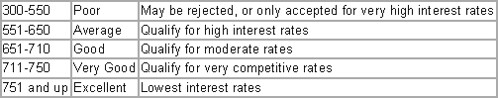

Potential lenders don’t check your entire credit report; they utilize your score to judge you. Different lending businesses use tailored strategies to look at credit scores for a variety of consumers. Besides, they use this model because different credit card companies have different credit score versions. Loan issuers would provide someone using a high score an upper hand compared to one using a minimal score. In rare cases, your application might be prosperous, but you are going to pay high-interest rates and charges. It’s crucial to watch your finances to prevent damaging your credit score and report. You can track your score to give you a comprehensive overview of your credit score. The three data centers provide a free credit report to consumers each year. Catch a copy of your report and inspect the elements hurting your credit rating — such as fraud or errors. You should begin working on the easy items before involving paralegals in removing the complex ones. If you need a credit repair firm, pick one which matches your unique needs. Always make sure you keep good financial habits and check your report often.

0 comentário