The FCRA explicitly claims that you can dispute any negative item on a credit report

Several credit repair businesses are across the spectacle of charge restoration. Locating a valid business may be hard as there are a lot of reviews on the web. Virtually everyone who has gone through this procedure understands how it can help reestablish a busted report. In this age, you are able to search the internet to obtain the ideal repair choices you have. A search would yield several repair companies, and finding the perfect one could be daunting. Besides, no one wants to spend money to get a service which has no guaranteed outcomes. Having been in business since 2004, Lexington Law has a favorable history of near two years. No doubt, staying in business with this doesn’t establish a provider is great — but that is not the case. In a highly-monitored surroundings, this company has continually maintained strict federal standards. Lexington Law has also helped customers achieve excellent results for close to two decades. As one of the top credit repair companies, Lexington Law is definitely worth your consideration.

Several credit repair businesses are across the spectacle of charge restoration. Locating a valid business may be hard as there are a lot of reviews on the web. Virtually everyone who has gone through this procedure understands how it can help reestablish a busted report. In this age, you are able to search the internet to obtain the ideal repair choices you have. A search would yield several repair companies, and finding the perfect one could be daunting. Besides, no one wants to spend money to get a service which has no guaranteed outcomes. Having been in business since 2004, Lexington Law has a favorable history of near two years. No doubt, staying in business with this doesn’t establish a provider is great — but that is not the case. In a highly-monitored surroundings, this company has continually maintained strict federal standards. Lexington Law has also helped customers achieve excellent results for close to two decades. As one of the top credit repair companies, Lexington Law is definitely worth your consideration.

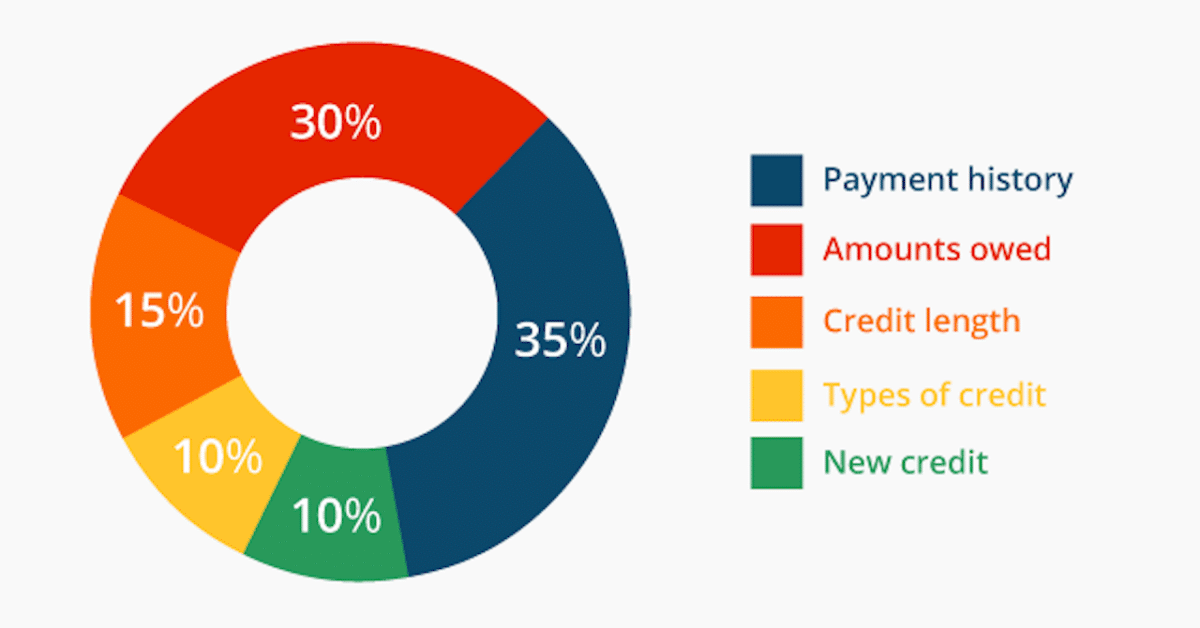

Without doubt, there are a lot of reasons to deteriorate your credit score and credit score. At a glance, credit repair is all about repairing your credit by eliminating the negative items. In certain situations, it entails disputing the things with the various data centres. If this situation happens to you, you might need to engage a credit repair company. The cause of which you are going to have to consider a repair company is that it will involve many legal measures. Additionally, fraud and identity theft typically entail a series of well-choreographed criminal activities. Unsurprisingly, unraveling the series of these chains can prove futile if you do it on your own. Even though you can complete the process by yourself, a credit repair company could be ideal. For this reason, you will sometimes need to hire a credit repair company to repair the elements. If you have any questions pertaining to wherever and how to use Credit tips, you can get hold of us at our own web site. However, you can successfully lodge a dispute and complete the process by yourself or use a repair agency.

Loan issuers will hardly accept your application for a new loan when you’ve got bad credit. Even though a loan is exactly what you need to construct your own credit, such a circumstance is certainly counterintuitive. But the excellent news is that you can find a secured credit card even with bad credit. Some creditors could be more willing to issue credit cards to customers even when they have history. Essentially, you are going to have to put a deposit that works as collateral in the event the balance goes unpaid. Card issuers accumulate basic identification information and financial information from the card applicants. Once you’ve given the issuer consent to perform a credit check, you’ll begin processing the deposit. Some card issuers also request your approval to allow them to withdraw the deposit directly from the accounts. Of course, secured credit cards possess a huge difference from the traditional cards. Although a secured credit card is different from the conventional ones, you will certainly enjoy some perks.

When you hunt’credit repair firm’ on google, you’ll see countless outcomes popping up. Having a mammoth of testimonials on the web, finding a legitimate one might be cumbersome. If you have been through a repair procedure before, you certainly know how it can heal a wounded report. Since lots of advice is published online, you can search the web to find the one that suits you. Considering that the internet is filled with many repair companies, locating the perfect one can be an intimidating task. Moreover, you wouldn’t want to spend funds on a business with no good history. Having helped many customers since 2004, Lexington Law has a substantial history. Arguably, remaining in business for long doesn’t guarantee results, but Lexington Law provides a good deal. Lexington Law is known for being compliant with exceptionally large Federal Standards. Lexington Law has also helped customers achieve excellent results for near two decades. Since this firm has an incredible track record, it’s undoubtedly worth to be contemplated.

In case you decide to involve a repair business, Credit Saint may be your perfect choice. As one of the few credit associations with an A+ BBB score, Credit Saint has a great deal to offer. As a reputable company that has worked for close to 15 decades, Credit Saint is one of the highest-ranked. One notable element is the way the provider always educates is clients on different credit issues. Moreover, it’s three packages– Polish, Clean Slate, and Credit Remodel — where you pick. As you move about the procedure, the legal team would prepare dispute letters to fit your specific needs. The company has a 90-day money-back guarantee that will assist you are given a refund if you’re not happy. Regardless of the mammoth of advantages, credit saint has several associated disadvantages also. The business is not available in most of the states and has incredibly high setup fees. Having said that, you may need to utilize other service providers if you live in South Carolina.

0 comentário