The FCRA provides the provision to remove any detrimental element in your credit report

Round the united states, with a credit card continues being among the most efficient financial instruments. Countless consumer stories point towards going through huge hurdles to obtaining one. Naturally, a charge card has its associated perks and a couple of disadvantages too. Before issuing you a card, charge card businesses consider several metrics before approving it. If you have a poor credit rating and background, your probability of obtaining a card would be meager. In addition, you are going to need to maintain good financial habits following a successful card program. If you go past the 30% credit usage limitation, your credit rating would undoubtedly drop. If you have any inquiries pertaining to in which and how to use Play.Google.com, you can get in touch with us at our own webpage. In addition, the application adds a tricky inquiry for your report, which also affects your score. The more your program flops, Credit Rates the further questions are added to a report. As soon as you receive the card, then adhering to the strict credit regulations would work to your leverage. In case you don’t stick to the stringent regulations, then you will undoubtedly get affected by the results.

No doubt, there are a lot of reasons to deteriorate your credit score and credit rating. In brief, credit repair is the process of enhancing your own credit by deleting the adverse entries. In some situations, it entails disputing the things together with the respective data centers. Contrary to the straightforward process of disputing negative things, identity theft could be painstaking. As a walkabout for this daunting process, you’ll have to hire a repair business to avoid complexities. Besides, fraud and identity theft usually involve a series of well-connected criminal activities. Unsurprisingly, unraveling the series of these chains can prove futile if you do it all on your own. While you are able to complete the process by yourself, a credit repair company could be ideal. Without a doubt, credit repair entails several complex stages which you have to pass. In whichever scenario, involving a fix company or working in your may be fruitful.

No doubt, there are a lot of reasons to deteriorate your credit score and credit rating. In brief, credit repair is the process of enhancing your own credit by deleting the adverse entries. In some situations, it entails disputing the things together with the respective data centers. Contrary to the straightforward process of disputing negative things, identity theft could be painstaking. As a walkabout for this daunting process, you’ll have to hire a repair business to avoid complexities. Besides, fraud and identity theft usually involve a series of well-connected criminal activities. Unsurprisingly, unraveling the series of these chains can prove futile if you do it all on your own. While you are able to complete the process by yourself, a credit repair company could be ideal. Without a doubt, credit repair entails several complex stages which you have to pass. In whichever scenario, involving a fix company or working in your may be fruitful.

Sky blue is a credit repair company that has been established in 1989 and based in Florida. Customers using credit saint to repair credit assert they begin seeing positive progress following 30 days. Additionally, the company argues that customers use their solutions for just six months to achieve complete results. When using sky blue charge, you’ll undoubtedly benefit from a mammoth of its associated advantages. During your membership, you are able to cancel or pause the support by calling customer support. If you are not able to achieve the desired effects, you can receive a refund so long as you claim within 90 days. No doubt, skies blue has its associated disadvantages — notably on the setup and credit report fees. You will cover a $39.95 retrieval fee even before beginning the credit repair process. Additionally, you’ll require a setup charge of $69 to start the process, and you will not be ensured effects. The sad part is that you can pay for months without seeing substantial progress on your report. Since repairing credit requires some substantial investment, you should make your choices carefully.

Sky blue is a credit repair company that has been established in 1989 and based in Florida. Customers using credit saint to repair credit assert they begin seeing positive progress following 30 days. Additionally, the company argues that customers use their solutions for just six months to achieve complete results. When using sky blue charge, you’ll undoubtedly benefit from a mammoth of its associated advantages. During your membership, you are able to cancel or pause the support by calling customer support. If you are not able to achieve the desired effects, you can receive a refund so long as you claim within 90 days. No doubt, skies blue has its associated disadvantages — notably on the setup and credit report fees. You will cover a $39.95 retrieval fee even before beginning the credit repair process. Additionally, you’ll require a setup charge of $69 to start the process, and you will not be ensured effects. The sad part is that you can pay for months without seeing substantial progress on your report. Since repairing credit requires some substantial investment, you should make your choices carefully.

Most of us pay bills — ranging from bank cards to loans, phones, and lines of credit. If you don’t fulfill your financial obligations on time, creditors will create efforts to collect their cash. Each time a collection service makes attempts to recover the cash, it provides to a report for a collection. While paid collections have significantly less impact on your score, outstanding collections may badly impact you. When one of your accounts gets regained by agencies, your score falls based on some variables. When you’ve got a high score, you’ll lose more points than someone with couple of points, and also the converse is true. If you skip a payment, your lender would report it to the bureaus as”payment” On the other hand, failure to pay the penalties will make a collection agency come for their money. Instantly you encounter a set; your credit rating will drop drastically. Since deleting a collection takes a great deal of money and time, making timely payments is the best strategy.

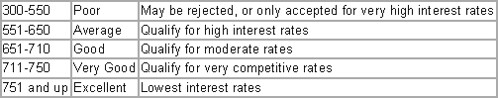

Your credit rating is a credit score snapshot with which lenders use to judge your creditworthiness. The credit rating calculation and evaluation versions differ between different loan issuers. Also, credit card companies also use tailored strategies when assessing a credit report. Loan issuers might give someone using a high score an upper hand compared to one with a minimal score. In rare cases, your program may be prosperous, but you are going to pay high-interest rates and fees. For this reason, you should watch your finances to assist you avoid any difficulties. Among the methods for tracking your finances, assessing your credit score often would assist you. Considering that the 3 agencies give free reports to customers each year, you should use it to your leverage. After regaining your report, you need to examine the items that seriously hurt your credit report. Focus on removing the items which you can before going for the ones which need legal procedures. There are many repair businesses; hence you should choose your desired one wisely. Checking your report regularly and maintaining sound fiscal habits would function to your leverage.

0 comentário