The FCRA explicitly claims that you can dispute any negative item on a credit report

Based in Florida, Sky blue charge is a credit repair firm that was established in 1989. Charge saint asserts that most customers start seeing positive outcomes after 30 days of usage. Moreover, the business asserts that customers use their solutions for just six months to realize complete results. Sky grim credit has many advantages, which include online credit checks and monitoring. In the duration of your subscription, you can pause the subscription by calling customer support. Additionally, you can get a refund as long as you maintain within 90 days of registration. Certainly, skies blue has some downsides, particularly on the installation and credit report fees. The first measure is paying a retrieval fee of $39.95 until they start fixing your credit. Besides, you’ll have to pay $69 to start the procedure though you won’t have a guarantee for results. The sad part is you may cover months without seeing considerable advancement on your report. Credit repair is a great investment; therefore you should make your decisions carefully.

Having bad credit isn’t the end of the street — you may make an application for a second chance checking account. Secondly chance checking account work if you’ve been unsuccessful in your credit application previously. Before approving a checking accounts, banks refer to the ChexSystems database. ChexSystems is a data center to which many financial institutions report bad credit behaviour. Appearing on ChexSystems means you don’t have a formerly excellent credit history. If your name appears on this database, then your odds of having a checking account would be slim. In case you cherished this post in addition to you wish to acquire more information relating to Credit Tips generously stop by our webpage. A few credit unions and banks provide second opportunity accounts to help you reconstruct a good report. However, you won’t find solutions that are in a regular checking account in another chance account. Like any other product, second chance checking account have advantages and disadvantages. Although you’ll certainly repair your credit with them, they generally have high fees. Additionally, you can’t use the overdraft feature since they’re meant to show your financial area. Regardless of the downsides, second chance checking is far better than secured credits card or check-cashing.

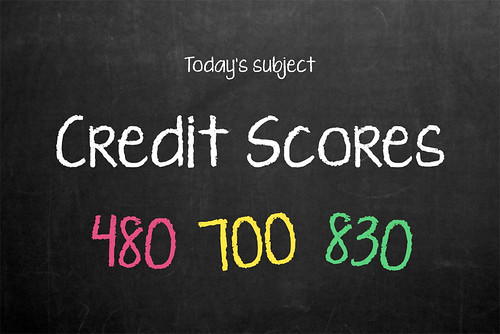

Delinquencies may lose your credit score by as much as 100 points. Timely payments accounts for a huge part of your report, making defaulting a negative component. Worse still, your score may continue plummeting if you currently have a low credit score. Sometimes it is reasonable to pay late due to a job loss on an unprecedented fiscal crisis. In case you had a hitch, then your loan credit or credit card company might provide you the window to stabilize. But, making late payments as a custom could affect your fiscal muscle. According to Federal law, a late payment is only going to be reported to the agencies is it is 30 days late. Going beyond this window could influence your ability to find additional loans from potential lenders. Having said that, surpassing this window would make lenders perceive you as a high-risk borrower. On a concluding note, making timely payments will work to your leverage.

Delinquencies may lose your credit score by as much as 100 points. Timely payments accounts for a huge part of your report, making defaulting a negative component. Worse still, your score may continue plummeting if you currently have a low credit score. Sometimes it is reasonable to pay late due to a job loss on an unprecedented fiscal crisis. In case you had a hitch, then your loan credit or credit card company might provide you the window to stabilize. But, making late payments as a custom could affect your fiscal muscle. According to Federal law, a late payment is only going to be reported to the agencies is it is 30 days late. Going beyond this window could influence your ability to find additional loans from potential lenders. Having said that, surpassing this window would make lenders perceive you as a high-risk borrower. On a concluding note, making timely payments will work to your leverage.

Credit Saint can be a perfect choice if you opt to call for a credit repair company. Credit Saint falls in the group of those few companies with an A+ BBB score; hence it has lots to give. As a reputable company that has worked for close to 15 decades, Credit Saint is one of the highest-ranked. One noteworthy element is how the company continuously educates is clients on various credit issues. It also has three payment options where you will choose based on your needs. Your assigned attorney would prepare customized letters to personalize your specific requirements. The business has a 90-day money-back guarantee that will help you are given a refund if you are not happy. Unsurprisingly, credit saint has some related drawbacks. Credit saint has significantly large setup fees and has limited availability. If you’re living in South Carolina, you may need to look for the assistance of other service providers.

Credit Saint can be a perfect choice if you opt to call for a credit repair company. Credit Saint falls in the group of those few companies with an A+ BBB score; hence it has lots to give. As a reputable company that has worked for close to 15 decades, Credit Saint is one of the highest-ranked. One noteworthy element is how the company continuously educates is clients on various credit issues. It also has three payment options where you will choose based on your needs. Your assigned attorney would prepare customized letters to personalize your specific requirements. The business has a 90-day money-back guarantee that will help you are given a refund if you are not happy. Unsurprisingly, credit saint has some related drawbacks. Credit saint has significantly large setup fees and has limited availability. If you’re living in South Carolina, you may need to look for the assistance of other service providers.

The FCRA provides the provision to eliminate any harmful element in your credit report. Essentially, if the reporting agency can not verify the product, it surely must be eliminated. The 3 information centres — Experian, Equifax, and TransUnion — are prone to making mistakes in reports. The FCRA claims that near one in every five Americans have mistakes in their reports. Your credit report is directly proportional to a score, meaning that a bad report could hurt you. For any typical loan or credit, your credit score tells the kind of consumer you are. Most loan issuers turn down programs since the customers have a poor or no credit score report. That said, you should operate to delete the harmful entries from your credit report. Late payments, bankruptcies, challenging questions, compensated collections, and fraudulent activity can impact you. Since negative things can affect you badly, you need to work on eliminating them from the report. There are different means of removing negative things, and one of these is a credit repair firm. Most men and women use credit repair companies when they must go through lots of legal technicalities. Since credit fix can be a daunting process, we’ve compiled everything you need to know here.

0 comentário