Dependent on the FCRA’s provisions, you can retrieve and dispute any negative information in your report

Federal bankruptcy courts made this provision to cancel debts from people and businesses. Declaring bankruptcy might help you avoid the debt, but it’s vital to comprehend the implications. While filing a bankruptcy seems like a fantastic deal, you don’t wish to suffer consequences that may last a decade. With bankruptcy, you will not be able to negotiate for good quality credit or credit cards. At a glimpse, filing for bankruptcy could force you to experience countless hurdles and legal complexities. You will want to demonstrate your inability to pay the loan and undergo credit counseling ahead. Then, the thing would force you to pick between chapter 7 or chapter 13 bankruptcy. Whichever the case, you’re pay the related fees — both court charges and attorney fees. Avoiding bankruptcy is an perfect choice since you’ll lose considerably more than what you’ve got. Moreover, a bankruptcy tanks that your credit score and paints you as not creditworthy.

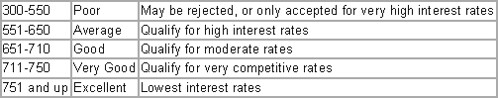

According to the FCRA, it is possible to dispute any negative element on your credit report. Mostly, if the credit bureau can not confirm the information, it must delete it. Like any other thing, credit data centers tend toward making a great deal of errors, especially in a credit report. A close evaluation of American consumers shows that about 20% of them have errors in their reports. Your credit report is directly proportional to your score, which means that a bad report may hurt you. Moreover, your score determines your creditworthiness — for any conventional or lines of credit loan. In many cases, a bad score could impair your ability to acquire positive rates of interest and quality loans. That said, it’s imperative to work on removing negative entries from your credit report. There are lots of negative things which, if you don’t give adequate attention, could hurt your document. Since harmful elements can damage your report severely, you should work on their deletion. Among the ways that work with maximum efficacy is using a credit repair company to delete the products. Several consumers choose to utilize a repair company when they realize they can not go through all hoops. In this guide, we have collated everything you want to learn about credit restoration.

Across the united states, a charge card continues to be among the most coveted monetary tools. Countless consumer accounts point to their unbowed attempts to obtaining a credit card. As you’ll certainly enjoy the advantages of this card, the downsides are inevitable. First card issuers think about several components of your credit report before approving your application. This factor means that your chances of acceptance if you’ve got a bad score, are incredibly slim. After getting the card, you’ll need to check your spending habits, payment history, and utilization. If you go beyond the 30% credit usage limitation, your credit score will undoubtedly drop. Moreover, the application adds a tricky inquiry to your report, which certainly tanks your own score. The further you have unsuccessful applications, the more inquiries you are going to have in your report. Many issuing companies have unbelievably high regulations that govern card use and usage. If you don’t stick to the strict regulations, then you’ll definitely get affected by the results.

Delinquencies can lose your credit score by as much as 100 points. Timely payments accounts for a vast part of your report, which makes defaulting a negative element. Your credit rating could continually plummet in the event that you already possess a significantly low score. In some instances, it’s reasonable to default due to a fiscal crisis or unprecedented scenarios. In case you had a hitch, your loan credit or charge card company might provide you the window to stabilize. While this provision is most common, defaulting always could affect your financial wellness. The federal law states that late payments could only be reported if they are 30 days late. In the future, you won’t have the ability to get decent quality loans should you continually make late payments. That is because potential lenders will consider you a speculative debtor and reject your program. Having said that, should you make timely payments continually, you’ll have the upper hand in borrowing.

Launched in 1989, sky blue is a credit repair company That’s based in Florida Clients using credit saint to repair credit claim that they begin seeing positive advancement following 30 days. If you have just about any questions concerning where by and also the way to utilize credit card tips, you can e-mail us with the internet site. The company argues that most customers use the service after six weeks to get complete satisfaction. From online credit checks and tracking, many perks are linked with this company. During your membership, you are able to cancel or pause the service by calling customer support. Additionally, you can get a refund as long as you maintain within 90 days of subscription. Without a doubt, sky blue has its own associated disadvantages — especially on the setup and credit report charges. You will pay a $39.95 retrieval fee even before commencing the credit repair process. Moreover, you’ll be required to pay a setup fee of $69 with no guarantee for reliable outcomes. The sad part is you may cover months without seeing substantial advancement in your report. Credit repair is an great investment; therefore you need to make your decisions carefully.

Launched in 1989, sky blue is a credit repair company That’s based in Florida Clients using credit saint to repair credit claim that they begin seeing positive advancement following 30 days. If you have just about any questions concerning where by and also the way to utilize credit card tips, you can e-mail us with the internet site. The company argues that most customers use the service after six weeks to get complete satisfaction. From online credit checks and tracking, many perks are linked with this company. During your membership, you are able to cancel or pause the service by calling customer support. Additionally, you can get a refund as long as you maintain within 90 days of subscription. Without a doubt, sky blue has its own associated disadvantages — especially on the setup and credit report charges. You will pay a $39.95 retrieval fee even before commencing the credit repair process. Moreover, you’ll be required to pay a setup fee of $69 with no guarantee for reliable outcomes. The sad part is you may cover months without seeing substantial advancement in your report. Credit repair is an great investment; therefore you need to make your decisions carefully.

0 comentário