Certainly, many items can influence your credit report and tank your own score

In brief, your own credit report entails your present financial situation and debt quantity. You will be eligible for a standard checking account if you have a good credit history. If that is not the situation, you may have to go to get a checking account for poor credit. During application, your previous history of making several accounts wouldn’t affect you. An overdraft won’t appear on your report unless you fail to make timely payments. But if the bank turns the bill to a collection agency, the overdraft might appear. Therefore, there are limited circumstances when a checking account could damage your credit rating. Some financial institutions can perform a soft inquiry when submitting an application for a checking account. One means that that it could tank your score and report is should you enroll overdraft protection.

Located in Florida, Sky blue credit is a credit repair company that has been created in 1989. Charge saint asserts that many consumers start seeing positive outcomes after 30 days of usage. Moreover, the business argues that clients use their solutions for six months to realize full results. Sky blue credit has many advantages, which include online credit ratings and monitoring. In the duration of your subscription, you can pause the subscription by calling customer support. Additionally, you can get a refund as long as you maintain within 90 days of registration. Without a doubt, skies blue has some drawbacks, particularly on the installation and credit report charges. The preliminary measure is paying a retrieval fee of $39.95 until they begin fixing your credit. Besides, you are going to need to pay $69 to begin the procedure even though you won’t have a warranty for results. The sad part is you may cover months without seeing considerable advancement on your report. Credit repair is an great investment; hence you need to make your choices carefully.

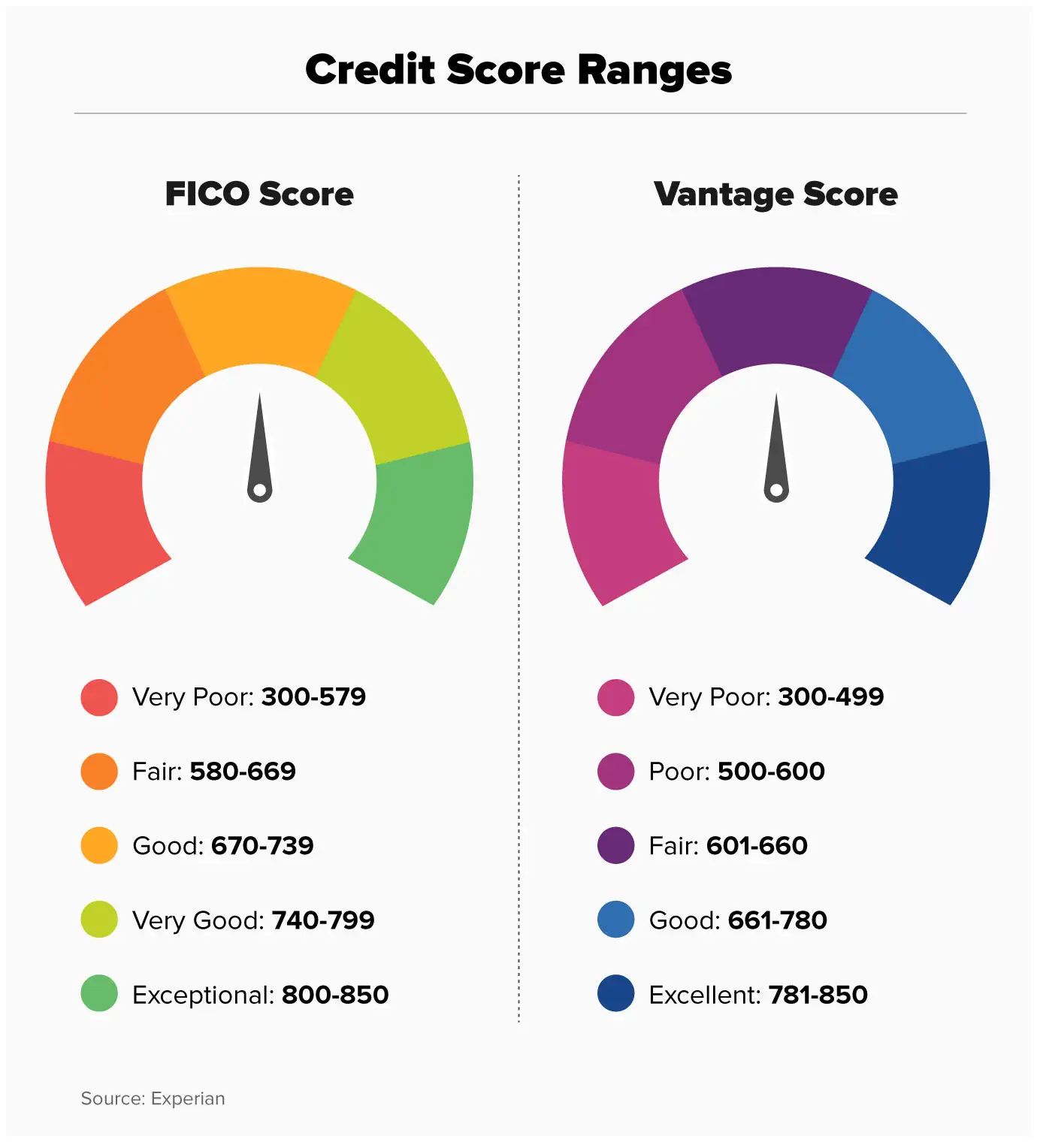

Instead of assessing your entire report, prospective lenders use your credit score to judge you. Different lending businesses use tailored approaches to look at credit scores for various consumers. Besidesthey use this model because different credit card companies have different credit rating models. Once you have poor credit, lenders will less likely contemplate your loan applications. If your program gets powerful, you’ll pay expensive rates of interest and fees. For this reason, keeping your eye on your financing would help keep you on top of your financing. Assessing your credit score regularly would provide you a clear summary of your fiscal well-being. The 3 data centers give a free credit report to consumers every year. As soon as you retrieve your credit report, you should check the items which hurt your credit score. Before focusing on complicated items, begin by working on straightforward elements. If you may need a credit repair company, be sure to select the one which fits your needs and budget. Always make sure you keep good financial habits and check your report often.

Established in 1989, sky blue is a credit repair company That’s based in Florida Credit saint argues that most consumers begin seeing positive results after 30 days of usage. It argues that several clients use the service for six months for gratification. Out of online credit checks and tracking, many perks are directly associated with this corporation. During your membership, you are able to cancel or pause the support by contacting customer service. If you don’t achieve your desired outcome, you can receive a complete refund within 90 days of your claim. Besides the advantages, skies blue has some related drawbacks too. You will pay a $39.95 retrieval fee even before commencing the credit repair process. Moreover, you’ll need to pay $69 to begin the procedure even though you won’t have a guarantee for results. The sad part is you may cover months without seeing substantial advancement in your report. Since going the process of credit repair isn’t cheap, you need to select your choices carefully.

In a nutshell, your credit report involves your current financial situation and debt volume. Ordinarily, you will be qualified for a standard checking account if you’ve got a good credit history. When you’ve got a terrible history, you might need to consider second chance checking account. Withdrawing, depositing, closing an account, or having multiple accounts would not impact you. If you have an overdraft, defaulting are a guarantee that it would look in your account. If you liked this post and you would like to obtain extra information concerning https://play.google.com/store/apps/details?id=com.creditoptimal.app135956&hl=no&gl=au kindly check out our own web-page. But if the bank turns the bill to a collection agency, the overdraft might seem. That said, there are limited scenarios when this accounts can drop your score. Some financial institutions may execute a soft query when submitting an application for a checking account. In conclusion, a soft inquiry and overdraft protection may normally make an impact on your credit score.

In a nutshell, your credit report involves your current financial situation and debt volume. Ordinarily, you will be qualified for a standard checking account if you’ve got a good credit history. When you’ve got a terrible history, you might need to consider second chance checking account. Withdrawing, depositing, closing an account, or having multiple accounts would not impact you. If you have an overdraft, defaulting are a guarantee that it would look in your account. If you liked this post and you would like to obtain extra information concerning https://play.google.com/store/apps/details?id=com.creditoptimal.app135956&hl=no&gl=au kindly check out our own web-page. But if the bank turns the bill to a collection agency, the overdraft might seem. That said, there are limited scenarios when this accounts can drop your score. Some financial institutions may execute a soft query when submitting an application for a checking account. In conclusion, a soft inquiry and overdraft protection may normally make an impact on your credit score.

Potential lenders do not check your whole credit report; they utilize your score to judge you. Different lending businesses use tailored approaches to look at credit scores for a variety of consumers. Besidesthey use this model because different credit card companies have different credit score models. As soon as you have poor credit, lenders will less likely contemplate your loan applications. In rare circumstances, your program may be prosperous, but you are going to pay high-interest rates and charges. Therefore, keeping your eye on your financing would help keep you on top of your finances. Assessing your credit score regularly would give you a clear summary of your fiscal well-being. You’ll be able to recover a free credit report from each of the data centers for free. Grab a copy of your report and inspect the elements hurting your credit score — like fraud or errors. Before focusing on complicated products, begin by working on simple elements. If you might require a credit repair firm, be sure to pick the one which suits your needs and budget. Assessing your report regularly and maintaining sound fiscal habits would function to your leverage.

0 comentário