According to the FCRA, you can dispute any negative element on your credit report

According to the FCRA, it is possible to dispute any negative element on your credit report. The credit reporting bureau is obligated to delete a disputed item that is shown to be illegitimate. Charge information facilities make lots of mistakes — which makes such mistakes highly prevalent. The FCRA claims that close to one in every five Americans have errors in their accounts. Since your score is dependent on your report, a bad report may damage your score severely. Because your score tells the kind of consumer you’re, you need to put heavy emphasis on it. Most loan issuers turn down programs since the customers have a bad or no credit report. Ever since your loan negotiation capacity would be crippled because of negative entries, you need to delete them. There are lots of negative items which, if you do not give adequate attention, could hurt your report. Since damaging elements on a credit report can impact you, you need to try and eliminate them. You’re able to remove the negative items on your own or involve a credit repair firm. If you liked this article and you would like to acquire more info about Credit Rates kindly visit the webpage. Since this process involves lots of technical and legalities, most people opt for using a repair firm. Because credit fix can be a daunting process, we’ve compiled everything you need to learn here.

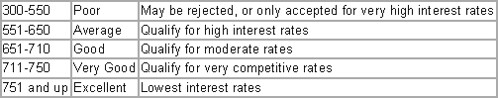

The FCRA explicitly claims you could dispute any negative item on a credit report. In nature, the responsible information center needs to delete the data if it can not verify it as legitimate. Credit information facilities make a lot of mistakes — making such errors highly prevalent. The FCRA reports that approximately 1 in every 5 Americans (20%) have errors in their credit reports. Since your score depends on your own report, a bad report could damage your score severely. Besides, your score determines your creditworthiness — for any standard or lines of credit loan. In many situations, a poor credit rating can influence your ability to acquire good quality loans. Having said that, it’s imperative to focus on removing negative entries from your credit report. By delinquencies to bankruptcies, compensated collections, and inquiries, such components can impact you. Since damaging things can impact you badly, you should work on removing them from your report. Besides removing the entries by yourself, one of the most effective methods is using a repair company. Many consumers choose to use a repair company when they recognize they can not undergo all hoops. In this guide, we’ve collated whatever you want to learn about credit restoration.

Defaulting can damage your credit report and shed your credit score significantly. Timely payments account for a huge part of your report, making defaulting a negative component. Worse still, your score could continue plummeting if you currently have a low credit score. Sometimes it’s reasonable to pay late due to a job loss on an unprecedented financial crisis. If you experienced some problem, your loan issuer could comprehend and provide you a bit of grace period. While this provision is most common, defaulting always could change your financial health. The federal law states that overdue payments would only be reported when they are 30 days late. However, exceeding this 30-day window will cripple your ability to get decent quality loans. The reason behind this factor is that potential lenders would consider you a high-risk borrower. In conclusion, making timely payments will undoubtedly work to your leverage.

Primarily, several things could be harmful to your credit report and tank your credit score. At a glance, credit fix is all about repairing your credit by eliminating the negative items. In some cases, deleting the negative entries may be as simple as disputing the items with the bureaus. For this kind of situation, you might be forced to call for a credit repair company to repair it. The reason for which you are going to have to think about a repair company is that it will involve many legal steps. Fraud and identity theft involves well-connected criminal actions; you’ll require a repair firm. Unsurprisingly, unraveling the series of these chains may prove useless if you do it all on your own. Even though you can complete the process by yourself, a credit repair company could be ideal. Certainly, credit repair entails several complicated phases which you have to pass. In any instance, you may finish the process independently or employ a credit repair firm.

Consumers’ desire for loans and failure to meet their obligations caused bankruptcies. While it could help you avoid debt, you have to comprehend the long-term consequences. While submitting a bankruptcy sounds like a good bargain, you do not wish to suffer effects that may last a decade. Besides, a bankruptcy could cripple your negotiating capability for positive rates of interest or credit cards. When filing for bankruptcy, you’re experience countless hurdles and legal complexities. Besides needing to prove you can’t cover the loan, you will also have to go through credit counseling. Then, the entity would force you to choose between chapter 7 or chapter 13 bankruptcy. Whichever the case, you’ll pay the related fees — both courtroom fees and attorney fees. Since you’ll lose much more than you gain, averting filing for bankruptcy is an perfect option. Moreover, it severely damages your credit and affects how prospective lenders would see you.

Consumers’ desire for loans and failure to meet their obligations caused bankruptcies. While it could help you avoid debt, you have to comprehend the long-term consequences. While submitting a bankruptcy sounds like a good bargain, you do not wish to suffer effects that may last a decade. Besides, a bankruptcy could cripple your negotiating capability for positive rates of interest or credit cards. When filing for bankruptcy, you’re experience countless hurdles and legal complexities. Besides needing to prove you can’t cover the loan, you will also have to go through credit counseling. Then, the entity would force you to choose between chapter 7 or chapter 13 bankruptcy. Whichever the case, you’ll pay the related fees — both courtroom fees and attorney fees. Since you’ll lose much more than you gain, averting filing for bankruptcy is an perfect option. Moreover, it severely damages your credit and affects how prospective lenders would see you.

0 comentário