Dependent on the FCRA’s provisions, you can recover and dispute any negative information on your report

Federal bankruptcy courts came up with bankruptcies to reduce significant financial burdens on individuals. Filing bankruptcy may offset some debt from you, but you should know several implications. While filing a bankruptcy seems like a good bargain, you do not wish to endure effects that may last a couple of years. With bankruptcy, you won’t have the ability to negotiate for great quality credit or credit cards. At a glance, bankruptcy is undoubtedly a process filled with lots of cumbersome legal hoops. The first step would be expressing your inability to pay the loan and moving through credit counseling. Following this step, you are going to have to choose whether to file chapter 7 or chapter 13 bankruptcy. Whichever the bankruptcy, you’re pay the court fees and attorney fees. Since you’ll lose a whole lot more than you gain, averting filing for bankruptcy is an ideal option. Moreover, a bankruptcy tanks that your credit score and paints you as not creditworthy.

In case you choose to call for a repair company, Credit Saint may be your perfect choice. As one of the few credit associations using an A+ BBB rating, Credit Saint has a great deal to offer. Credit Saint has helped consumers resolve credit issues for more than a decade hence has a fantastic history. One significant element is how Credit Saint educates consumers about different credit problems. Additionally, it has three payment options where you will select based on your needs. When preparing dispute letters, the paralegals customize the promises based on your precise requirements. It’s great knowing that they have a 90-day money-back guarantee if you are not completely satisfied. Unsurprisingly, credit saint has some related drawbacks. Credit saint has significantly high installation fees and has limited availability. If you are residing in South Carolina, you might have to seek the assistance of other service providers.

In case you choose to call for a repair company, Credit Saint may be your perfect choice. As one of the few credit associations using an A+ BBB rating, Credit Saint has a great deal to offer. Credit Saint has helped consumers resolve credit issues for more than a decade hence has a fantastic history. One significant element is how Credit Saint educates consumers about different credit problems. Additionally, it has three payment options where you will select based on your needs. When preparing dispute letters, the paralegals customize the promises based on your precise requirements. It’s great knowing that they have a 90-day money-back guarantee if you are not completely satisfied. Unsurprisingly, credit saint has some related drawbacks. Credit saint has significantly high installation fees and has limited availability. If you are residing in South Carolina, you might have to seek the assistance of other service providers.

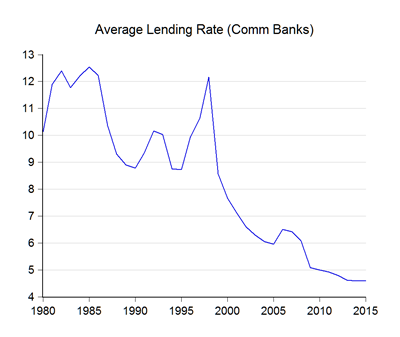

Since there are plenty of things that could damage your credit, you could be thinking about if it’s the loan does. At a glimpse, loans and Credit Rates how you manage them determine the score that you are going to ever have. As one of the critical elements from the calculation of your credit, loans can improve or decrease your score. If you don’t make timely payments, taking a loan out would be as excellent as tanking your credit score. Your credit report is a snapshot that lenders use to ascertain whether or not you are creditworthy. Because you require a loan to build a comprehensive history, this component may be counterintuitive. When this loan application is the first one, your odds of success might be very slim. For this reason, you’ll need a loan to qualify to get another loan. If you’ve cleared your invoices early before, they may consider you a creditworthy consumer. If you always make overdue payments, potential lenders will question your loan eligibility. Taking new loans may give you the chance to build your credit if you had damaged it. Since the amount of debt carries a massive chunk of your account (30 percent ), you should pay utmost attention to it.

The FCRA gives the provision to remove any detrimental element in your credit report. The credit reporting agency is obligated to delete a disputed thing that’s shown to be illegitimate. Since no thing is foolproof of creating errors, credit information centers have some mistakes in consumer reports. According to the FCRA, at least 20% of US citizens have confused in their credit reports. Since your report goes together with your score, a lousy report may severely damage your score. Besides, your score determines your creditworthiness — for any standard or lines of credit loan. In several conditions, a poor credit rating could influence your ability to acquire decent quality loans. That said, it is vital to work on removing negative entries from your credit report. Several negative entries on your credit report may cripple your ability to get good quality loans. Since damaging items can affect you badly, you need to work on eliminating them from your report. One of the ways that operate with maximum efficiency is having a credit repair company to delete the items. As this process involves a lot of specialized and legalities, most men and women opt for having a repair company. In this guide, we have collated everything you want to know about credit restoration.

The FCRA explicitly states that you can dispute any negative item on a credit report. Basically, if the reporting agency can’t verify the item, it certainly has to be eliminated. Credit information centers make lots of mistakes — which makes such mistakes highly prevalent. The FCRA asserts that close to one in every five Americans have mistakes in their accounts. Ever since your report goes together with your score, a lousy report may severely damage your score. Moreover, your score determines your creditworthiness — to get any conventional or lines of credit loan. Oftentimes, a bad score may cripple your ability to get positive interest rates and quality loans. Since your loan negotiation capacity will be crippled because of negative entries, you should delete them. From delinquencies to bankruptcies, compensated collections, and inquiries, such components can affect you. Since harmful elements can harm your report severely, you should work on their deletion. In the event you loved this informative article and you wish to receive more details relating to Credit Rates generously visit the site. Among the ways that operate with maximum efficiency is having a credit repair business to delete the items. Many men and women use credit repair companies when they must go through plenty of legal technicalities. In this article, we have collated everything you need to learn about credit restoration.

0 comentário