Mostly, several items could be harmful to your credit report and tank your credit score

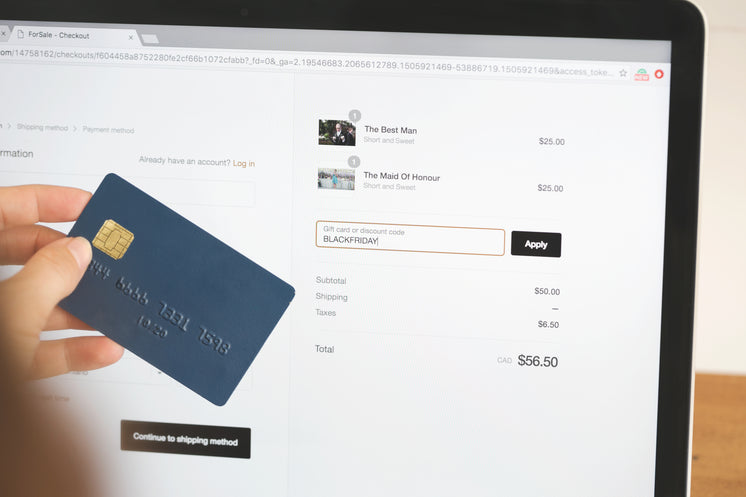

Across the united states, using a credit card proceeds being among the most efficient fiscal tools. Several people narrate how difficult it is to find a credit card without any problems successfully. Like any other solution, a credit card includes a wide range of advantages and related cons. First off, card issuers think about several elements of your own credit report before approving your application. This implies that having a poor credit score would undoubtedly influence your application’s success. After getting the card, you’ll need to check your spending habits, payment history, and credit score use. If you go past the 30% credit usage limitation, your credit rating will undoubtedly drop. Moreover, the program adds a hard inquiry to your account, which surely tanks your score. Should you make several unsuccessful programs, several inquiries could be added to your report. When it comes to utilizing the card, many issuers adhere to high regularity standards. Failure to adhere to the criteria would hurt not only your score but also pose long-term consequences.

Located in Florida, Sky blue charge is a credit repair company that has been established in 1989. Charge saint argues that most consumers begin seeing positive outcomes after 30 days of usage. It argues that several clients use the service for six months for satisfaction. Sky grim credit has many advantages, which include online credit checks and monitoring. In the course of your subscription, you can pause the subscription by calling customer support. If you are unhappy with the service, you’ll be given a complete refund provided that you maintain it within 90 days. Like any other company, skies blue has its own associated disadvantages, like the installation and credit report charges. You’ll pay a $39.95 retrieval fee even before beginning the credit repair process. Despite not having the guarantee for results, you’ll have to pay $69 to prepare the procedure. The sad part is that you can pay for months without seeing considerable advancement on your report. Credit repair is an great investment; therefore you need to make your choices carefully.

Having bad credit is not the end of the street — you can make an application for a second chance checking accounts. Typically, second opportunity accounts are intended to help people whose applications have flopped. The bank would check your documents against ChexSystems before entrusting your application. ChexSystems is a data center to that most banks report poor credit utilization. Appearing on ChexSystems means that you don’t have a previously excellent credit history. Appearing on the ChexSystems database means your odds of success are incredibly low. Some financial institutions offer their clients another opportunity to construct a good credit report. But, there is a disparity between these accounts along with a typical checking account. Without a doubt, second chance checking account have advantages and disadvantages. Second chance checking account help you rebuild credit, but they have high prices. Moreover, you can’t register in an overdraft program since the account demonstrates your fiscal discipline. Despite the downsides, second chance checking is better than bonded credits card or even check-cashing.

Our bills vary from credit card payments, mortgages, phones, and utility payments. If you don’t finish the obligations in time, creditors will make efforts to collect their money. Also known as collections, the efforts made by creditors to collect their dues could affect your report. According to FICO, unpaid collections will affect you more than paid collections. Your score will fall depending on some factors whether one of your account goes into collection. The impact of a set on someone with a very low score isn’t as severe as in somebody with a high score. Remember that creditors report every missed payment as”late payment” to the bureaus. But if you don’t pay penalties or bring your account to status, you may encounter a collection. As soon as an account is reported a collection, you’ll instantly experience a plummet on your score. Since it takes a long time to resolve a collection, making timely payments is the best strategy.

Most of us make payments at the end of the month — from telephone to utilities and lines of credit. In case you don’t meet your financial obligations in time, creditors will create attempts to collect their money. Generally speaking, these efforts, also known as sets, can negatively affect your credit score. The latest FICO calculation model points to how unpaid collections would affect your score. If among your accounts goes into collection, your credit score plummets depending on some elements. If you’ve got a high score, you’ll lose more points than somebody with few points, and also the converse is true. Missing a payment would make your loan score report it as”late payment” into the 3 bureaus. If you don’t restore your account from its bad state, you can experience a collection. When your account enter collection, you’ll instantly see your credit score falling. As it takes a long time to resolve a collection, making timely payments is your ideal strategy If you cherished this write-up and you would like to acquire extra data regarding Play.google.com kindly stop by our web site. .

Most of us make payments at the end of the month — from telephone to utilities and lines of credit. In case you don’t meet your financial obligations in time, creditors will create attempts to collect their money. Generally speaking, these efforts, also known as sets, can negatively affect your credit score. The latest FICO calculation model points to how unpaid collections would affect your score. If among your accounts goes into collection, your credit score plummets depending on some elements. If you’ve got a high score, you’ll lose more points than somebody with few points, and also the converse is true. Missing a payment would make your loan score report it as”late payment” into the 3 bureaus. If you don’t restore your account from its bad state, you can experience a collection. When your account enter collection, you’ll instantly see your credit score falling. As it takes a long time to resolve a collection, making timely payments is your ideal strategy If you cherished this write-up and you would like to acquire extra data regarding Play.google.com kindly stop by our web site. .

0 comentário