Without doubt, there are a lot of reasons to deteriorate your credit report and credit rating

If you choose to hire a credit repair firm, Credit Saint may be the perfect choice. Among the few credit associations using an A+ BBB rating, Credit Saint has a great deal to offer. Credit Saint has been in business for over ten years and among the highly-ranked repair businesses. One significant element is how Credit Saint educates consumers about different credit issues. Besides, Credit Saint accommodates different consumer needs using its own three payment packages. As you move about the procedure, the legal team would prepare dispute letters to suit your particular needs. If you are not fully satisfied, you are going to be able to receive a refund within 90 days of program. Besides all the perks of the business, credit saint has some disadvantages. From top installation fees to restricted availability, credit saint includes a few related downsides. Having said that, you might have to use other service providers if you reside in South Carolina.

The FCRA explicitly claims you could dispute any negative item on a credit report. Essentially, if the reporting agency can not confirm the product, it surely must be eliminated. Charge information centers make a lot of mistakes — which makes such errors highly prevalent. A close examination of American customers shows that about 20 percent of these have errors in their own reports. Your credit report relies in your score, and a lousy score could critically plummet your credit score. For any standard loan or credit, your credit score tells the kind of customer you’re. Many loan applicants have experienced an unsuccessful program because of a bad credit score. It’s essential to work on removing the negative entries from your report maintaining this factor in mind. Several negative entries in your credit report may cripple your ability to get decent quality loans. Detrimental entries can tank your credit score; hence you should try and remove all them. Apart from removing the entries on your own, among the most effective ways is utilizing a repair company. Since this process involves a lot of specialized and legalities, the majority of men and women opt for using a repair firm. To make certain you go through each of the steps with ease, we have compiled everything you need to learn here.

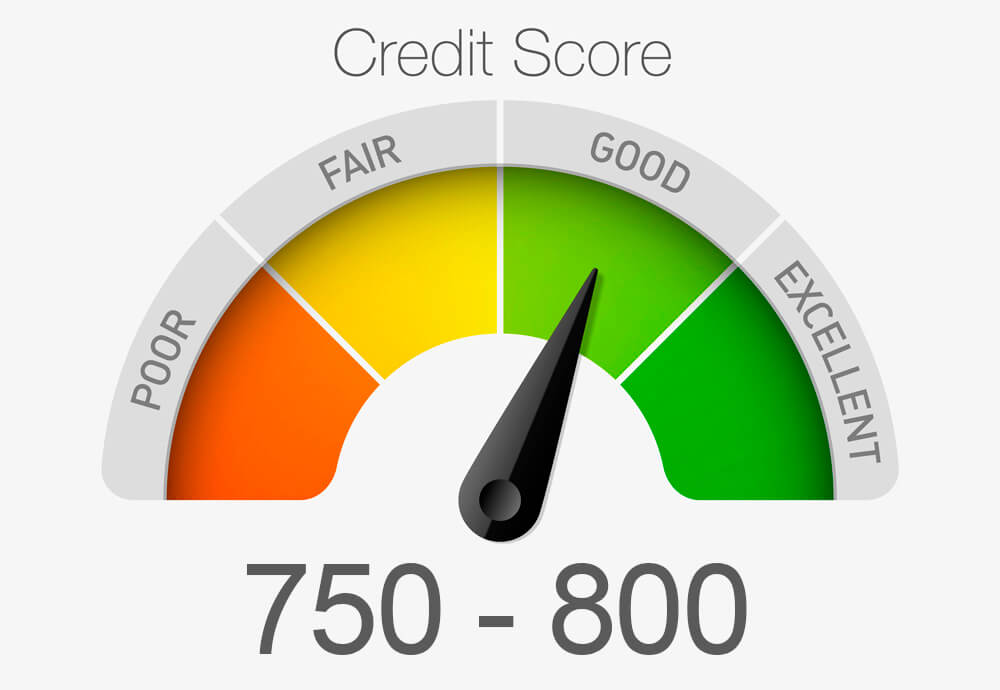

As opposed to a conventional page-by-page scrutiny, lenders frequently use your credit rating to judge you. Various loan issuers use customer-specific versions to check their customers’ credit reports. Additionally, credit card companies also use tailored strategies when checking a credit report. Once you’ve got bad credit, lenders will less likely consider your loan applications. If your application becomes successful, you’ll pay expensive interest rates and fees. For this reason, you should watch your finances to help you avoid any difficulties. Checking your credit rating is a powerful means of tracking your finances. You’ll be able to recover a free credit report from each of the data centers for free. As soon as you recover your credit file, you need to examine the items which hurt your credit score. Start by simply removing the easy items before engaging in the ones that need legal care. There are lots of repair businesses; hence you ought to choose your desired one wisely. Having great fiscal habits and assessing your report frequently would help keep you on top of your financing.

The FCRA gives the provision to remove any detrimental element in your credit report. The credit reporting agency is obligated to delete a disputed thing that is shown to be illegitimate. Since no entity is foolproof of creating errors, credit data centers have some errors in consumer reports. The FCRA asserts that close to one in every five Americans have mistakes in their reports. Your credit report depends in your score, and a bad score may seriously plummet your credit rating. Your score dictates your own creditworthiness in any credit card program of conventional loans. When you liked this short article and you wish to obtain guidance relating to Play.Google.Com i implore you to stop by our page. In several situations, a poor credit rating can affect your ability to acquire decent quality loans. That said, you should work to delete the detrimental entries in the credit report. From delinquencies to bankruptcies, paid collections, and inquiries, such elements can affect you. Since negative components on a credit report may impact you, you should make an effort and remove them. There are different ways of removing negative things, and one of them is a credit repair company. As this procedure involves lots of specialized and legalities, most men and women opt for using a repair company. Because credit repair can be an overwhelming process, we’ve compiled everything you want to learn here.

Defaulting can damage your credit report and shed your credit score significantly. Timely payments accounts for a huge part of your report, which makes defaulting a negative element. Your credit score could always plummet in the event that you already possess a considerably low score. Making late payments is occasionally understandable because of some fiscal catastrophe. In case you had a hitch, your loan issuer or credit card company might provide you the window to stabilize. In the event that you continuously make late payments, potential creditors could see you at another perspective. The federal law explicitly states that loan issuers can not report a late payment; it is not older than 30 days. However, exceeding this 30-day window will cripple your ability to acquire decent quality loans. Having said that, exceeding this window will make creditors perceive you as a speculative debtor. On a finishing note, making timely payments would function to your leverage.

Defaulting can damage your credit report and shed your credit score significantly. Timely payments accounts for a huge part of your report, which makes defaulting a negative element. Your credit score could always plummet in the event that you already possess a considerably low score. Making late payments is occasionally understandable because of some fiscal catastrophe. In case you had a hitch, your loan issuer or credit card company might provide you the window to stabilize. In the event that you continuously make late payments, potential creditors could see you at another perspective. The federal law explicitly states that loan issuers can not report a late payment; it is not older than 30 days. However, exceeding this 30-day window will cripple your ability to acquire decent quality loans. Having said that, exceeding this window will make creditors perceive you as a speculative debtor. On a finishing note, making timely payments would function to your leverage.

0 comentário