Mostly, several things could be detrimental to your credit report and tank your credit rating

No doubt, there are a lot of reasons to deteriorate your credit score and credit rating. Primarily, credit fix involves fixing your credit by minding the harmful items. Charge repair might be as simple as disputing the unwanted items with the various bureaus. In the event you’re a victim of fraud or identity theft, you might need to engage a credit repair firm. Since fixing fraud issues involves a great deal of legal complexities, you might have to hire a repair company. Fraud and identity theft entails well-connected criminal activities; you are going to need a repair company. In case you don’t engage a credit repair firm, unraveling these links may prove futile. Although some customers have solved identity theft on their own, Credit Card Tips a fix service is often an perfect way. Admittedly, deleting negative entrances involves a massive of complexities and legal technicalities. In whichever situation, involving a fix company or working on your own might be fruitful.

The FCRA provides the provision to remove any detrimental element on your credit report. Mostly, if the credit bureau can not confirm the information, it must delete it. Since no entity is foolproof of creating errors, credit information centers have some errors in consumer reports. In accordance with the FCRA, at least 20 percent of US taxpayers have confused in their credit reports. Since your score is dependent on your report, a bad report could damage your score seriously. Besides, your score determines your creditworthiness — for any standard or lines of credit loan. Several loan applicants have had an unsuccessful application due to a low credit score. It is essential to work on removing the negative entries from your report maintaining this factor in mind. Several negative entries in your credit report can cripple your ability to acquire good quality loans. Since harmful elements can harm your report seriously, you need to work in their deletion. There are different means of removing negative items, and among them is a credit repair company. Most men and women use credit repair businesses when they have to go through lots of legal technicalities. Because credit repair can be a daunting process, we’ve compiled everything you want to learn here.

Based on the FCRA, you can dispute any unwanted element in your credit report. Primarily, if the credit bureau can not confirm the information, it has to delete it. Since no entity is foolproof of making errors, credit data centers have some errors in consumer reports. In accordance with the FCRA, at least 20% of US taxpayers have mistaken in their credit reports. Because your score is dependent on your report, a bad report could damage your score severely. Besides, your score determines your creditworthiness — to get any conventional or lines of credit loan. In several conditions, a poor credit rating can influence your ability to get good quality loans. Having said that, you should work to delete the harmful entries from your credit report. From delinquencies to bankruptcies, compensated collections, and inquiries, such elements can impact you. Because harmful elements can harm your report severely, you need to work on their deletion. There are distinct ways of removing negative items, and one of them is a credit repair company. Many consumers opt to utilize a repair company when they recognize they can’t go through all hoops. Since credit fix can be an overwhelming process, we’ve compiled everything you need to learn here.

The FCRA explicitly states that you can dispute any negative item on a credit report. In nature, the responsible data center has to delete the information if it can’t confirm it as valid. Since no entity is foolproof of creating errors, credit information centers have some mistakes in consumer reports. The FCRA asserts that near one in every five Americans have errors in their accounts. Because your score is dependent on your own report, a bad report may damage your score seriously. Besides, your score determines your creditworthiness — to get any standard or lines of credit loan. Most loan issuers turn down programs since the customers have a bad or no credit report. Ever since your loan negotiation ability would be crippled because of negative entries, you should delete them. Late payments, bankruptcies, hard questions, compensated collections, and fraudulent activity can impact you. Because harmful elements can harm your report severely, you should work in their deletion. One of the ways that operate with maximum efficacy is having a credit repair business to delete the items. Most consumers involve a repair company whenever there are plenty of legal hoops and technicalities to pass. Since credit fix can be a daunting process, we’ve compiled everything you want to know here.

The FCRA explicitly states that you can dispute any negative item on a credit report. In nature, the responsible data center has to delete the information if it can’t confirm it as valid. Since no entity is foolproof of creating errors, credit information centers have some mistakes in consumer reports. The FCRA asserts that near one in every five Americans have errors in their accounts. Because your score is dependent on your own report, a bad report may damage your score seriously. Besides, your score determines your creditworthiness — to get any standard or lines of credit loan. Most loan issuers turn down programs since the customers have a bad or no credit report. Ever since your loan negotiation ability would be crippled because of negative entries, you should delete them. Late payments, bankruptcies, hard questions, compensated collections, and fraudulent activity can impact you. Because harmful elements can harm your report severely, you should work in their deletion. One of the ways that operate with maximum efficacy is having a credit repair business to delete the items. Most consumers involve a repair company whenever there are plenty of legal hoops and technicalities to pass. Since credit fix can be a daunting process, we’ve compiled everything you want to know here.

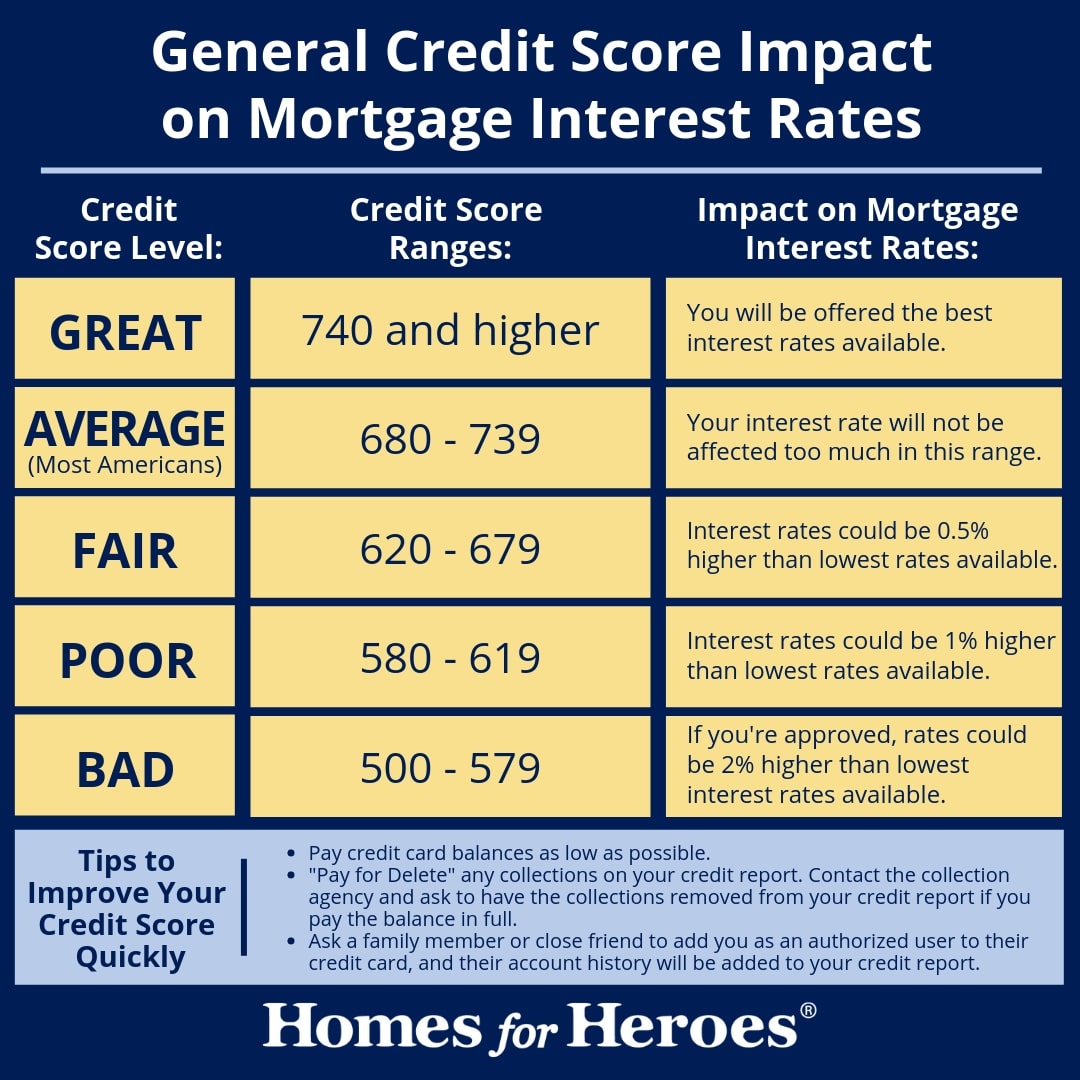

Our bills vary from credit card payments, mortgages, telephones, and utility payments. If you don’t finish the payments in time, lenders will make attempts to collect their money. Generally speaking, these attempts, also known as collections, can negatively affect your credit rating. While compensated collections have significantly less effect on your score, unpaid collections may badly affect you. Your score will drop based on a few variables whether one of your accounts goes into collection. The effects of a collection on someone with a low score is not as intense as in somebody with a high score. Recall that each missed payment is reported as”late payment” into the three credit bureaus. In case you loved this article and you would want to receive details relating to play.Google.com kindly visit our website. Failing to repair your account’s bad state would make a collection service come for their cash. Your credit rating will begin falling after your accounts goes into collection. Since deleting a collection takes a great deal of money and time, making timely payments is your best strategy.

Our bills vary from credit card payments, mortgages, telephones, and utility payments. If you don’t finish the payments in time, lenders will make attempts to collect their money. Generally speaking, these attempts, also known as collections, can negatively affect your credit rating. While compensated collections have significantly less effect on your score, unpaid collections may badly affect you. Your score will drop based on a few variables whether one of your accounts goes into collection. The effects of a collection on someone with a low score is not as intense as in somebody with a high score. Recall that each missed payment is reported as”late payment” into the three credit bureaus. In case you loved this article and you would want to receive details relating to play.Google.com kindly visit our website. Failing to repair your account’s bad state would make a collection service come for their cash. Your credit rating will begin falling after your accounts goes into collection. Since deleting a collection takes a great deal of money and time, making timely payments is your best strategy.

0 comentário