There are plenty of items which could affect your credit report and tank your own score

Federal bankruptcy courts designed this provision to cancel debts from individuals and Credit Tricks companies. While it could help you avoid debt, you need to comprehend the long-term consequences. While submitting a bankruptcy sounds like a fantastic bargain, you don’t wish to endure consequences that may last a decade. Besides, a bankruptcy would reduce your success rate of negotiating for favorable interest prices. When filing for bankruptcy, you’ll experience countless challenges and legal complexities. The very first step will be expressing your inability to pay the loan and moving through credit counseling. After counseling, you’ll choose the bankruptcy category to file: either chapter 7 or chapter 13. Whichever the case, you’ll pay the associated fees — both court fees and attorney fees. Filing bankruptcy has severe consequences, hence avoiding it’s an ideal option. Moreover, it severely damages your credit and impacts how prospective creditors would see you.

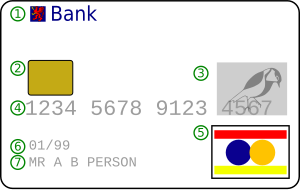

Round the US, using a credit card continues being one of the most efficient fiscal instruments. Undeniably, nearly everyone in the US functions to get financial freedom using a credit card. As you’ll certainly enjoy the perks of the card, the downsides are inevitable. First off, charge card issuers look at your score before issuing you a credit card. This means that having a bad credit score would undoubtedly affect your application’s success. Moreover, you are going to want to watch a couple of items once you get your card. If you exceed the 30% utilization threshold or default in your payments, your credit rating will drop. Additionally, the application adds a tricky inquiry to your account, which also impacts your score. The further you have failed software, the more inquiries you’ll have in your report. Several issuing companies have unbelievably substantial regulations that govern card usage and utilization. Failure to adhere to the criteria would hurt not just your score but also pose long-term implications.

Round the US, using a credit card continues being one of the most efficient fiscal instruments. Undeniably, nearly everyone in the US functions to get financial freedom using a credit card. As you’ll certainly enjoy the perks of the card, the downsides are inevitable. First off, charge card issuers look at your score before issuing you a credit card. This means that having a bad credit score would undoubtedly affect your application’s success. Moreover, you are going to want to watch a couple of items once you get your card. If you exceed the 30% utilization threshold or default in your payments, your credit rating will drop. Additionally, the application adds a tricky inquiry to your account, which also impacts your score. The further you have failed software, the more inquiries you’ll have in your report. Several issuing companies have unbelievably substantial regulations that govern card usage and utilization. Failure to adhere to the criteria would hurt not just your score but also pose long-term implications.

Consumers’ appetite for failure and loans to fulfill their obligations caused bankruptcies. Declaring bankruptcy could cancel some debt, but you will undoubtedly suffer its long term implications. You might have a temporary relief if you file for bankruptcy, but its effects may last for a couple of years. Besides, a bankruptcy would cripple your negotiating capability for favorable interest rates or credit cards. In a glimpse, bankruptcy is unquestionably a process full of lots of cumbersome legal hoops. Before filing, you are going to need to show that you can’t pay the loan and undergo counselling as well. Following this step, you are going to have to choose whether to file chapter 7 or chapter 13 bankruptcy. Whichever the class you choose, you’ll have to pay court charges and attorney fees. If you treasured this article and you simply would like to acquire more info regarding Credit tricks nicely visit the web-page. Preventing bankruptcy is an perfect choice since you’ll lose considerably more than what you gained. Additionally, it would alter the perspective with which potential lenders would see you.

Across the US, with a credit card proceeds being one of the most efficient fiscal tools. Countless consumer accounts point to their unbowed attempts to obtaining a credit card. While you’ll certainly enjoy the perks of the card, the downsides are inevitable. First off, credit card issuers look over your score prior to issuing you credit card. When you have a poor credit score and history, your chances of getting a card could be meager. Moreover, you’ll need to see a few items once you acquire your card. Should you exceed the 30% use threshold or default in your payments, your credit rating will drop. Besides, sending your program authorizes the issuer to execute a hard question which affects your score. The further you have unsuccessful software, the more inquiries you are going to have on your report. Once you receive the card, then adhering to the strict credit regulations will function to your leverage. If you are not able to adhere to the regulations, then you’re experience long-term consequences in your report.

The FCRA explicitly claims that you can dispute any negative item on a credit report. The credit reporting agency is bound to delete a disputed thing that is shown to be illegitimate. Like any other entity, credit data centers tend toward making a great deal of mistakes, particularly in a credit report. The FCRA reports that approximately 1 in every 5 Americans (20 percent ) have errors in their credit reports. Since your score is dependent on your report, a bad report may damage your score seriously. For any typical loan or line of credit, your credit score tells the type of consumer you’re. In many cases, a bad score could impair your ability to get favorable interest rates and quality loans. It is essential to focus on removing the negative entries from your report maintaining this element in mind. Several negative entries in your credit report can cripple your ability to get good quality loans. Since damaging things can impact you badly, you need to work on removing them from your report. There are distinct ways of removing negative things, and among them is a credit repair firm. Many consumers opt to use a repair business when they recognize they can’t go through all hoops. In this article, we’ve collated whatever you need to learn about credit repair.

0 comentário