No doubt, there are a lot of reasons to deteriorate your credit report and credit rating

If your program has been unsuccessful, you could open a second chance checking accounts. Typically, second opportunity accounts are intended to help people whose applications have flopped. The bank would check your records against ChexSystems before entrusting your application. ChexSystems is a data centre to which most financial institutions report poor credit behavior. If your records seem in ChexSystems, your credit history could be flawed and not as creditworthy. Appearing about the ChexSystems database means your odds of success are incredibly low. A few credit unions and banks provide second chance accounts that will assist you rebuild a good report. But, there’s a disparity between these accounts and a typical checking accounts. Certainly, second chance checking accounts have advantages and Credit Tips disadvantages. Secondly chance checking accounts help you rebuild credit, however they have high prices. Additionally, you can not use the overdraft feature because they’re intended to demonstrate your fiscal discipline. Despite the downsides, second chance checking is better than bonded credits card or even check-cashing.

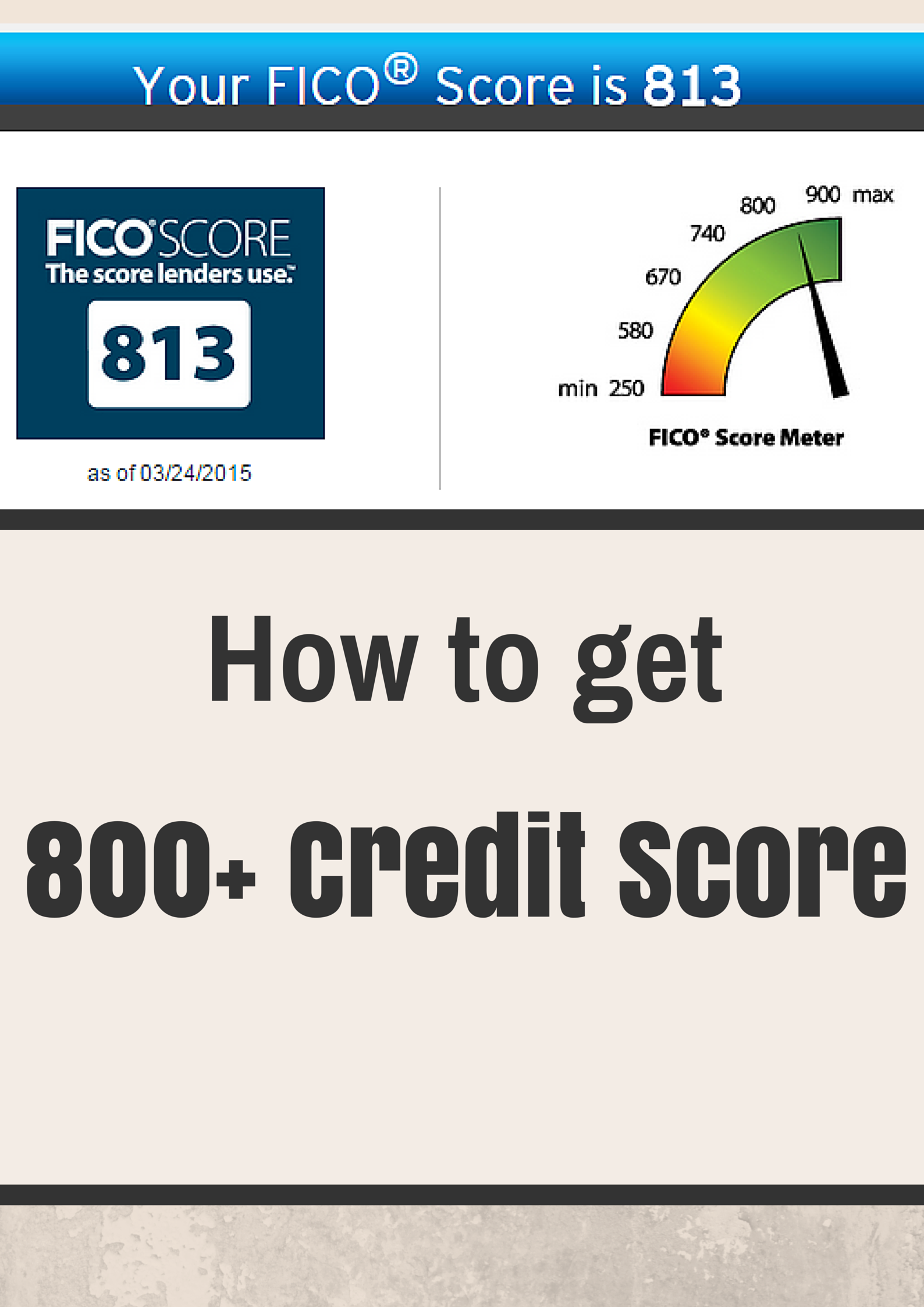

Rather than assessing your entire report, prospective lenders use your credit score to judge you. Various lending businesses utilize customized approaches to look at their customers’ reports. Similarly, credit card companies use various strategies to check their consumer credit reports. Your application will less likely succeed if you have a bad credit score and report. If your program gets successful, you’re pay expensive rates of interest and fees. For those who have any kind of issues relating to wherever in addition to how to make use of Credit Tips, you are able to e mail us in our web site. Therefore, tracking your financing would help you stay on top of those. Checking your credit score regularly would give you a very clear summary of your fiscal well-being. You’ll be able to retrieve a free credit report from each of the information centers for free. Once you recover your credit report, you should check the items that hurt your credit score. Before focusing on complicated items, start by working on straightforward elements. There are many repair businesses; hence you should select your desired one wisely. Checking your report often and maintaining sound fiscal habits will function to your leverage.

Rather than assessing your entire report, prospective lenders use your credit score to judge you. Various lending businesses utilize customized approaches to look at their customers’ reports. Similarly, credit card companies use various strategies to check their consumer credit reports. Your application will less likely succeed if you have a bad credit score and report. If your program gets successful, you’re pay expensive rates of interest and fees. For those who have any kind of issues relating to wherever in addition to how to make use of Credit Tips, you are able to e mail us in our web site. Therefore, tracking your financing would help you stay on top of those. Checking your credit score regularly would give you a very clear summary of your fiscal well-being. You’ll be able to retrieve a free credit report from each of the information centers for free. Once you recover your credit report, you should check the items that hurt your credit score. Before focusing on complicated items, start by working on straightforward elements. There are many repair businesses; hence you should select your desired one wisely. Checking your report often and maintaining sound fiscal habits will function to your leverage.

Loan issuers will barely accept your application for a new loan when you’ve got bad credit. Even though a loan is exactly what you want to build your own credit, such a circumstance is certainly counterintuitive. All is not lost, however. You can apply for a secured credit card even in the event that you’ve got bad credit. Several businesses are known for giving consumers credit cards with zero history. The card issuer would expect you to cover some amount as a deposit when applying for the card. After applying, you’ll want to give identification information and financial details. As the card issuer checks your credit file, you are going to begin processing the security. In some cases, the bank may require your bank account where they will debit the deposit sum. Like any other provider, guaranteed credit cards have some variation from the conventional credit card. Although a secured credit card differs from the traditional ones, you’ll certainly enjoy some perks.

Having bad credit isn’t the end of the street — you may apply for a second chance checking account. Ordinarily, second chance accounts are intended to help individuals whose programs have flopped. Before approving a checking accounts, banks refer to the ChexSystems database. ChexSystems is an information centre to which many banks report poor credit use. Hunting on ChexSystems means you don’t have a previously excellent credit history. This means that in the event that you’ve got a flawed history, your own success rate would undoubtedly be slim. Some credit unions and banks provide this second chance accounts that will assist you repair credit. But, there’s a disparity between these accounts and a normal checking account. Of course, second chance checking accounts have enormous advantages and a few downsides as well. Even though it’s possible to use second chance checking accounts to rebuild credit, they generally have high fees. Worse still, you can’t overdraw funds from your second chance checking accounts. The bright side of the account is that it’s far better than guaranteed credit cards or check-cashing.

Credit Saint can be an ideal choice if you opt to involve a credit repair company. As it’s got an A+ rating based on BBB, Credit Saint has plenty of suitable items to offer. Credit Saint has helped consumers resolve credit problems for over a decade hence has a fantastic history. One of the best perks of Credit Saint is the way that it educates consumers about various credit issues. To adapt different customer needs, Credit Saint includes three payment choices. As you move about the procedure, the legal staff would prepare dispute letters to suit your specific requirements. It is great knowing they have a 90-day money-back guarantee if you are not entirely pleased. But like any other service supplier, Credit Saint has its associated downsides. From top setup fees to limited accessibility, credit saint has a few associated downsides. That said, you may need to utilize other support providers if you live in South Carolina.

Credit Saint can be an ideal choice if you opt to involve a credit repair company. As it’s got an A+ rating based on BBB, Credit Saint has plenty of suitable items to offer. Credit Saint has helped consumers resolve credit problems for over a decade hence has a fantastic history. One of the best perks of Credit Saint is the way that it educates consumers about various credit issues. To adapt different customer needs, Credit Saint includes three payment choices. As you move about the procedure, the legal staff would prepare dispute letters to suit your specific requirements. It is great knowing they have a 90-day money-back guarantee if you are not entirely pleased. But like any other service supplier, Credit Saint has its associated downsides. From top setup fees to limited accessibility, credit saint has a few associated downsides. That said, you may need to utilize other support providers if you live in South Carolina.

0 comentário